U.S. Economic Report – December 31, 2018

Economic Overview Fourth Quarter 2018

During the third quarter of 2018, the U.S. economy grew at 3.4% over the prior quarter. Despite recent turmoil in equities markets, economic indicators point toward continued economic growth.

Overview of the U.S. Economy

According to the third estimate released by the Bureau of Economic Analysis (BEA), the U.S. economy grew in the third quarter of 2018, with real gross domestic product (GDP) increasing at an annual rate of 3.4%, following a second quarter 2018 increase of 4.2%. The increase in real GDP in the first quarter reflected positive contributions from PCE, private inventory investment, nonresidential fixed investment, federal government spending, and state and local government spending that were partly offset by the negative effects from exports and residential fixed investment.1 This brings the US economy its eighteenth consecutive quarter with positive GDP growth. For comparison, the longest streak of consecutive quarters is thirty-nine, which occurred between 1991 and 2001. Economic Overview Fourth Quarter 2018.

Forecasters surveyed by the Federal Reserve Bank of Philadelphia predicted, on average, a 2.6% annual real growth rate for the fourth quarter of 2018 and 2.4% for the first quarter of 2019. The forecasters predicted, on average, that real GDP will grow 2.9% in 2018, 2.7% in 2019, 2.1% in 2020, and 1.7% in 2021. The forecasts for 2018, 2020, and 2021 are higher than previous estimates, while the forecast for 2019 is lower than previous estimates for the same periods.2

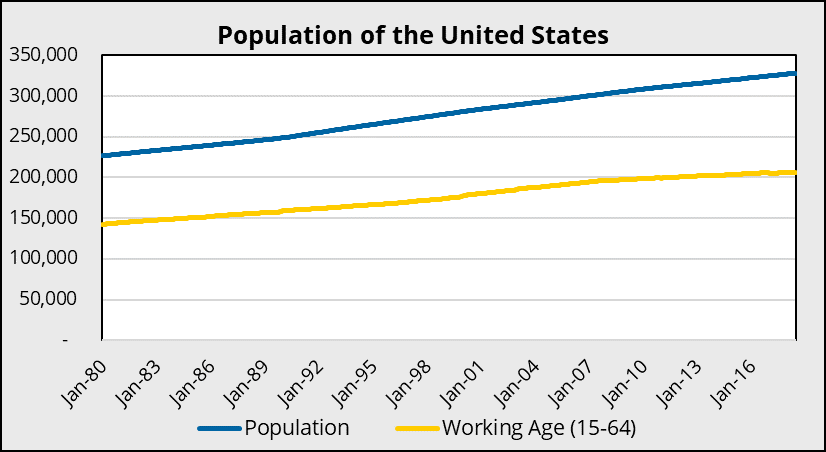

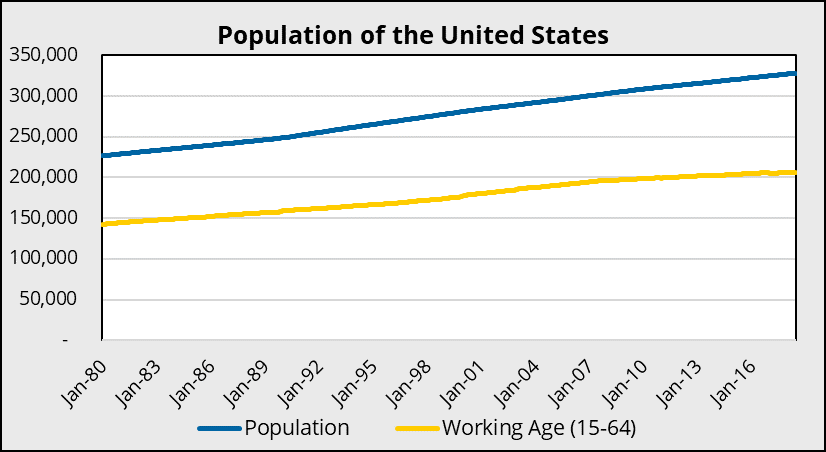

Population

Population growth is an important driver of long-term growth in an economy. The total population increased from 326.9 million in November 2017 to 329.2 million in November 2018.3 The working age population (15-64) increased from 205.8 million in November 2017 to 206.8 million in November 2018.4

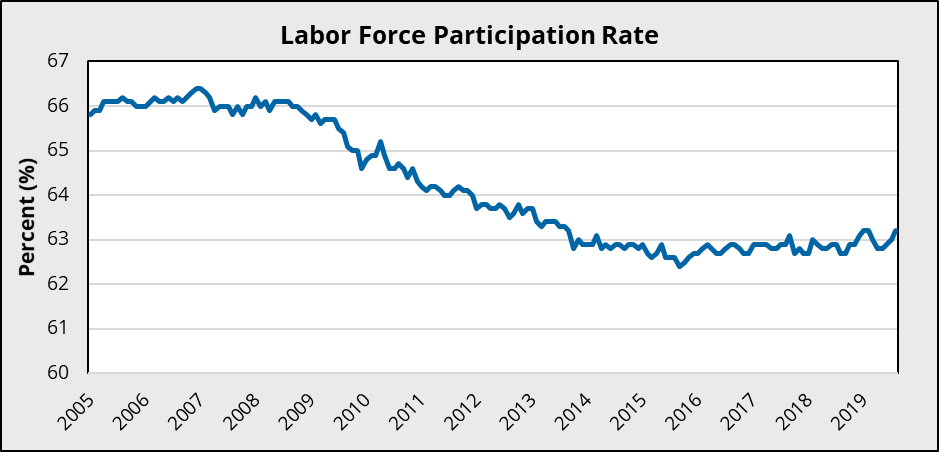

The labor force participation rate has hardly budged in recent years and remains lower than pre-2008 levels. In November 2018, the civilian labor force participation rate was 62.9%.5 The minimum participation rate in the past decade was 62.3%, recorded in September 2015, while the maximum of 66.4% was recorded in December 2006. This is at least partially explained by the aging population but could be evidence of slack in the labor force.

Employment

Nonfarm payroll employment, according to the Bureau of Labor Statistics (BLS), rose by 155,000 in November 2018. The unemployment rate (U3) in November 2018 was unchanged at 3.7%. The BLS reported job gains in health care, manufacturing, and transportation and warehousing.6 This is slightly below the Federal Open Market Committee (FOMC) participants’ projections of the long-run natural rate of unemployment, which have a range of 4.0 to 4.6%.

Forecasters surveyed by the Federal Reserve Bank of Philadelphia predicted, on average, that the unemployment rate will be 3.9% in 2018, 3.7% in 2019, 3.8% in 2020, and 4.0% in 2021.7

The U6 unemployment rate, which includes all marginally attached workers and those employed part-time for economic reasons, has declined from 8.0% in November 2017 to 7.6% in November 2018. The gap between U3 and U6 has declined from the 10-year high of 7.4% in September 2011 to 3.9% in November 2018.

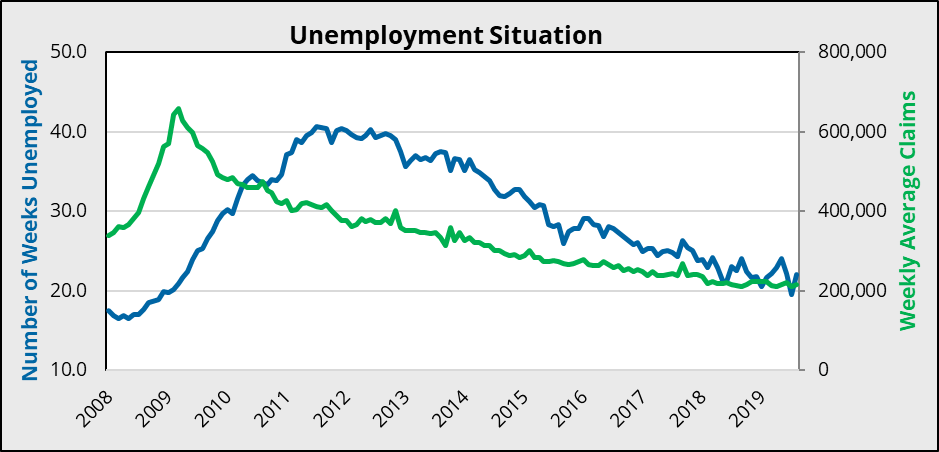

The average number of weeks unemployed has declined to near pre-2008 levels, to 21.7 weeks in November 2018, from 25.2 in November 2017. This is far below the 10-year high of 40.7 weeks in July 2011, and slightly above the 16.5 weeks in March 2008. The number of jobless claims has also been declining. For the week ending December 22, the number of seasonally adjusted jobless claims was 216,000, while for the prior year that number was 242,000.8

Inflation

According to the BLS, inflation, as measured by changes in the Consumer Price Index for All Urban Consumers (CPI-U), was unchanged in November 2018 on a seasonally adjusted basis. Over the previous 12 months, the all items index increased 2.2% before seasonal adjustment. The index for all items less food and energy rose 2.2% for the twelve-month period ending November 2018. The energy index rose 3.1% over the last year, while the food index increased 1.4%.9 The price pressures measures the probability that the personal consumption expenditures price index inflation rate will exceed 2.5% over the next twelve months. This price pressures measure reported a probability of 4.9% in December 2018, which is reasonably low relative to the past five years.10

Forecasters surveyed by the Federal Reserve Bank of Philadelphia predicted, on average, headline CPI inflation to be 2.4% in 2018, 2.3% in 2019, and 2.3% in 2020. Over the next ten years, forecasters expect CPI inflation to average 2.21% annually.11

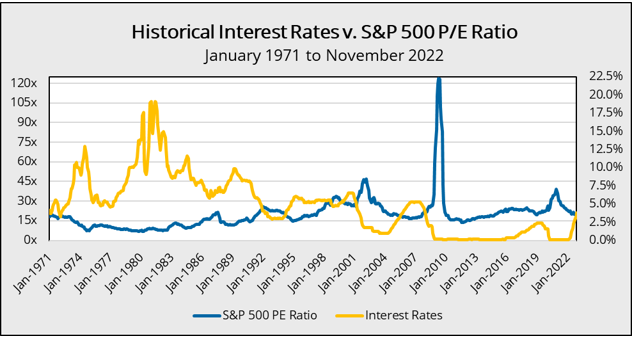

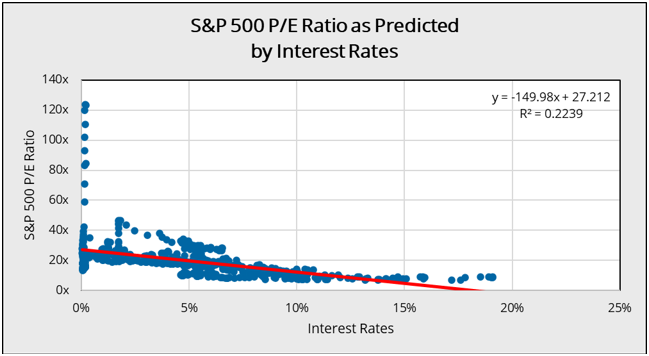

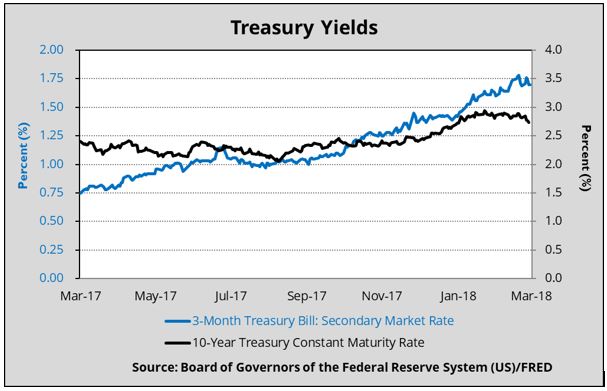

Interest Rates

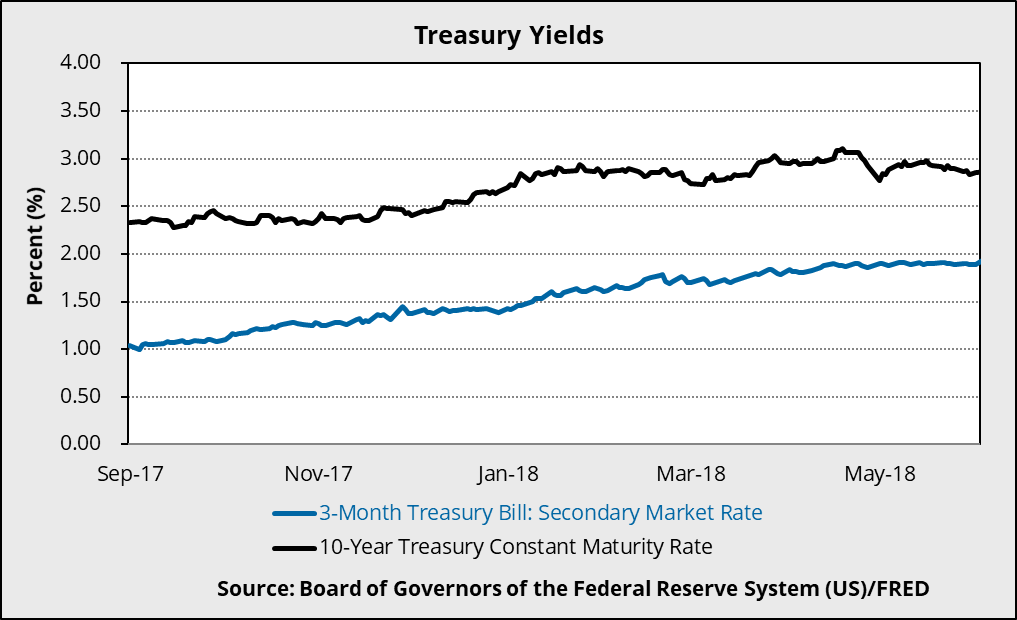

The interest rate on the three-month Treasury bill increased from 1.42% as of January 2, 2018 to 2.40% as of December 31, 2018.12 The interest rate on the ten-year Treasury note increased from 2.46% to 2.69% over the same period.13

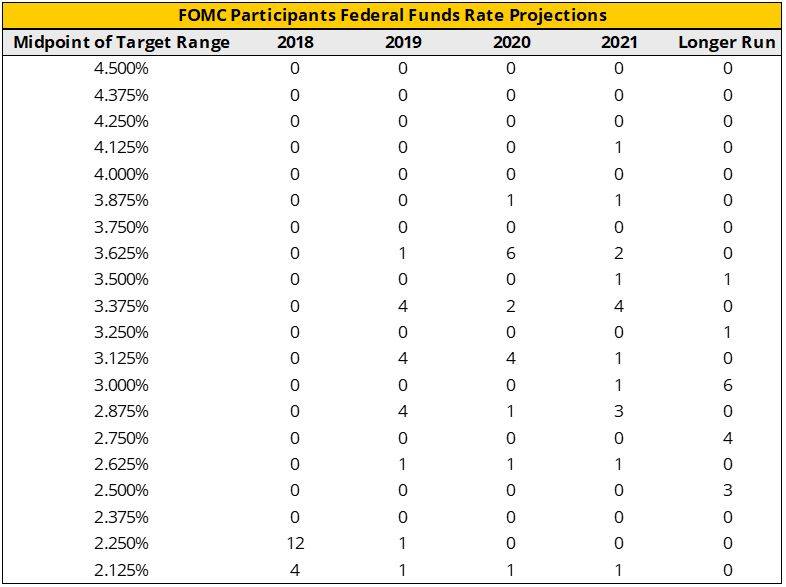

On December 19, 2018 the FOMC announced their decision to increase the federal funds target range from 2.0 – 2.25% to 2.25 – 2.5%. This increase was anticipated, and the FOMC’s added the following sentence to their official statement:

The Committee judges that risks to the economic outlook are roughly balanced, but will continue to monitor global economic and financial developments and assess their implications for the economic outlook.14

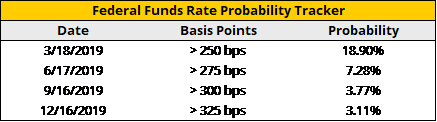

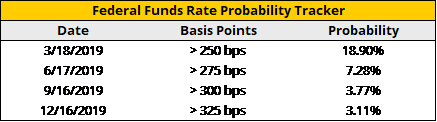

The following charts display projections from FOMC participants of the midpoint of the federal funds target range at the end of each calendar ear, as well as the implied probabilities of the federal funds rate path from federal funds rate futures markets. 15, 16 Most FOMC participants have revised their forecast of the federal funds rate from three rate hikes in 2019 down to two.

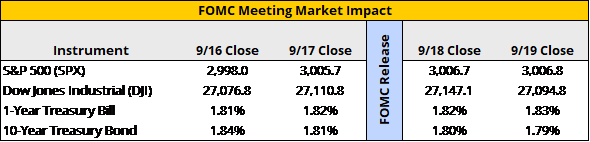

The following table below represents the market’s reaction during the lead up to and following the FOMC meeting.

As of December 31, 2018, the yields on Moody’s Aaa-rated corporate bonds and Baa-rated corporate bonds were 3.99% and 5.14%, respectively.17

The spread between the twenty-year and the one-year treasury bills declined from 0.82% as of December 29, 2017 to 0.24% as of December 31, 2018.18 A combination of increasing short-term interest rates from federal funds rate hikes and tempered long-term growth expectations have caused the yield curve to flatten in recent years. The spread between long- and short-maturity Treasury securities have long been used as a predictive measure for future economic performance. A recent paper from the Federal Reserve showed that the probability of a near-term recession has increased in recent years.19 However, when additional information was incorporated into their model, such as the excess bond premium,20 the component of corporate bond spreads in excess of an estimate of the compensation for expected default losses, the recession probability was significantly lower.

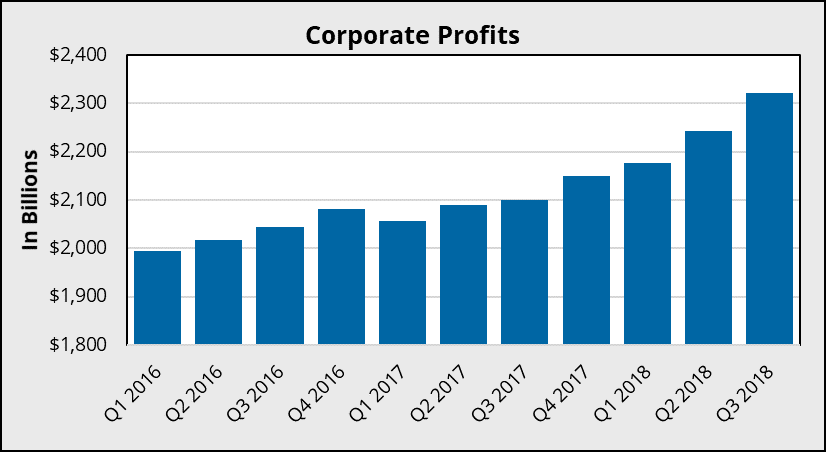

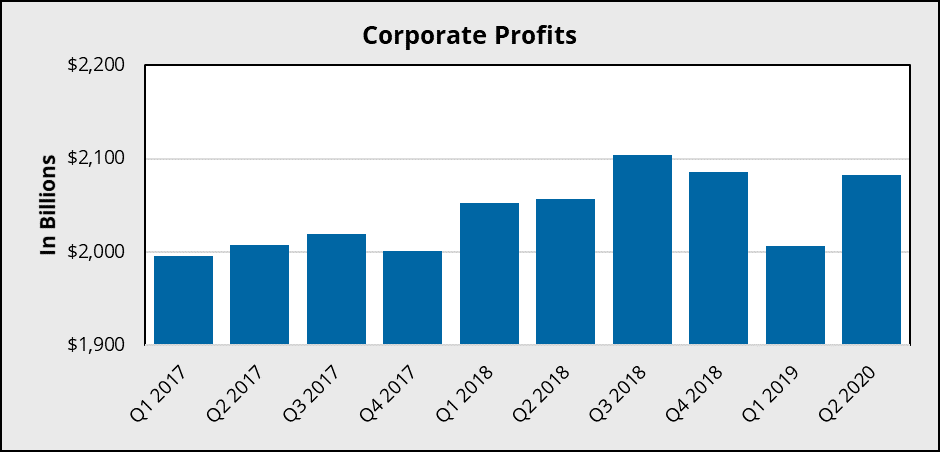

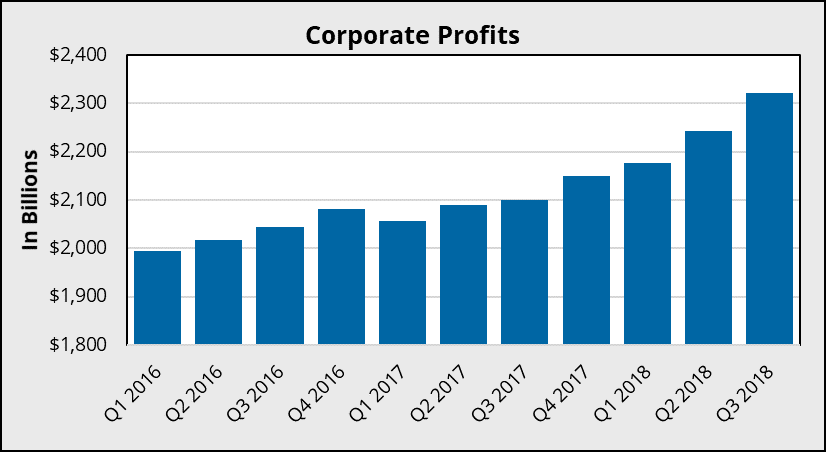

Corporate Profits

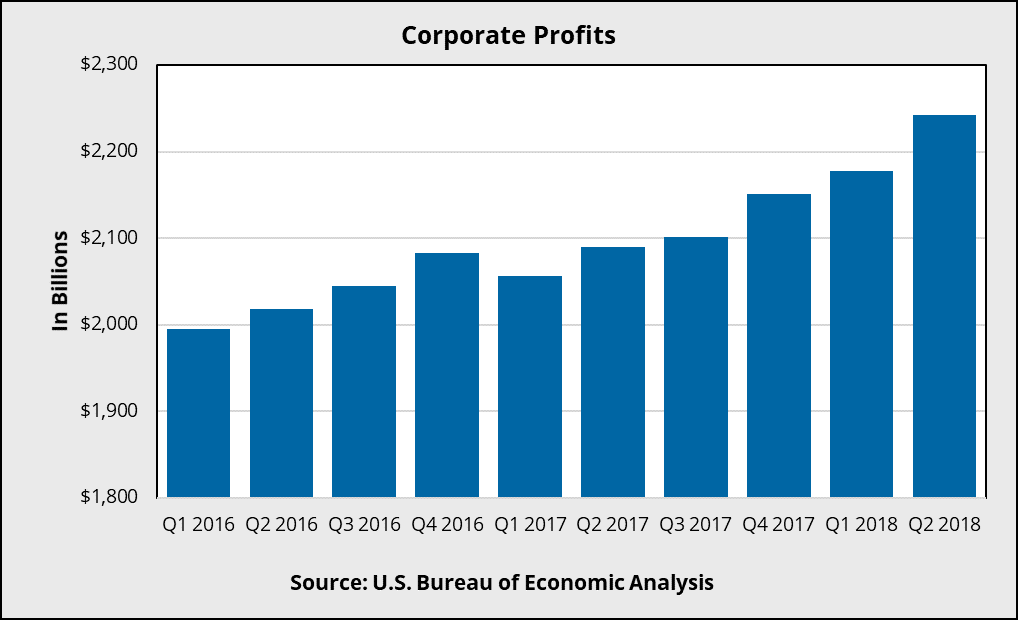

According to the BEA, profits from current production (corporate profits with inventory valuation and capital consumption adjustments) increased $78.2 billion in the third quarter of 2018 over the second, compared to an increase of $65.0 billion in the second quarter of 2018 over the first.21

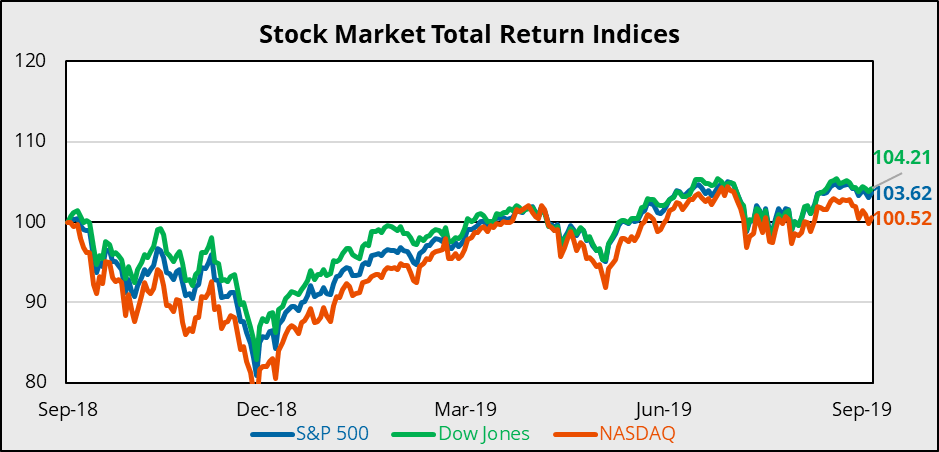

Stock Markets

The S&P 500 Total Return22 Index closed at 4,672.65 on December 29, 2017 and closed lower at 4,441.63 on December 31, 2018. This corresponds to an annual return of negative 4.9%. The Dow Jones Industrial Average Total Return Index closed at 53,317.96 on December 29, 2017 and closed lower at 51,462.77 on September 30, 2018. This corresponds to an annual return of negative 3.5%. The NASDAQ Composite Total Return Index closed at 7,935.29 on December 29, 2017 and closed lower at 7,709.91 on December 31, 2018.23 This corresponds to an annual return of negative 2.8%. In the graph below, the December 29, 2017 values were set to 100. Each of these indices were near their all-time highs in September.

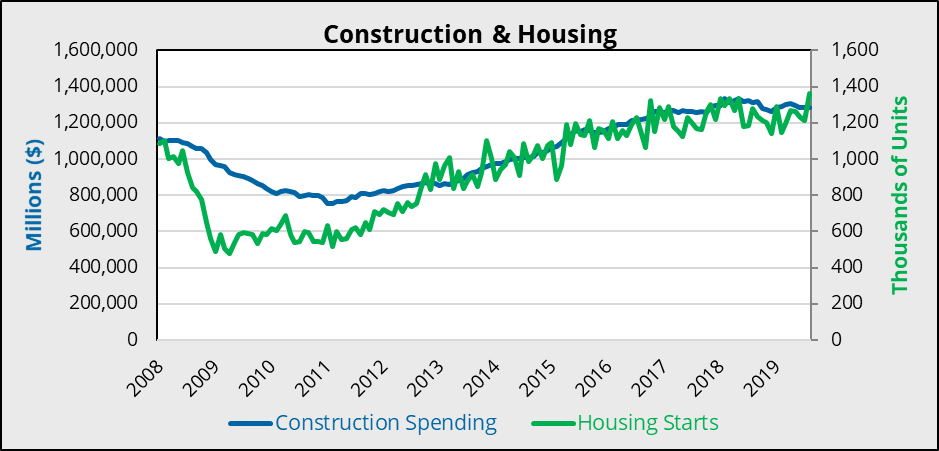

Construction & Housing Starts

Construction spending and housing starts are two other important indicators for the economy. Construction spending may indicate the sentiment in real estate markets and the soundness of the economy, while housing starts are an alternative indicator of consumer sentiment. Increases in demand for newly-constructed homes can lead to job growth in the construction industry, increased demand for appliances and furniture, and can have a ripple effect throughout the economy. Housing starts decreased from 1,265 thousand units in October 2017 to 1,217 thousand units in October 2018.24 Construction spending, a seasonally adjusted annual rate, increased from $1,247,531 million in October 2017 to $1,308,848 million in October 2018.25

Consumer Confidence

The Conference Board reported that the Consumer Confidence Index decreased in December 2018 to 128.1, down from 136.4 in November 2018.26 The index is based on a survey of consumer perceptions of present economic conditions and expectations of future conditions. The survey is based on a representative sample of 5,000 U.S. households and is considered a leading indicator of future consumer expenditures and economic activity.

The University of Michigan Survey of Consumers reported that the Index of Consumer Sentiment increased in December 2018 to 98.3, up from 97.5 in November 2018 and 95.9 in December 2017.27 However, this is lower than the 10-year high in March 2018 of 101.4. The index is based on a survey of consumer perceptions of present economic conditions and expectations of future conditions. The survey is based on a sample of 500 phone interviews consisting of 50 core questions are conducted across the continental U.S. This is considered a leading indicator of future consumer expenditures and economic activity.

According to Surveys of Consumers chief economist, Richard Curtin, consumers reported more negative than positive news regarding job prospects for the first time in two years. It is possible that the recent stock market performance influenced the results of recent months and remains to be seen if this is indicative of a long-term trend.

Conclusion

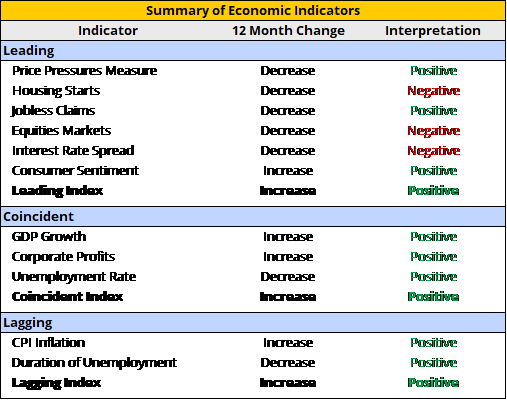

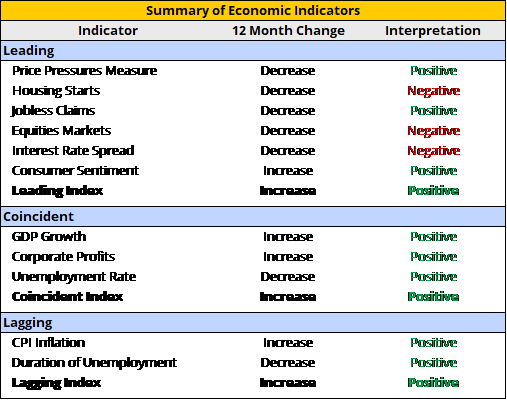

In conclusion, the economy continued to perform well in the third quarter of 2018, which bodes well for the fourth. Economic growth continued to exceed expectations, inflation has been modest while unemployment remains low, hovering around FOMC participants’ projections of the natural rate of unemployment. Equities markets, however, have experienced volatility in recent months, erasing the gains seen over the course of 2018. Consumer and investor sentiment remain optimistic, despite a recent downward tick. Threats to the economy include potential ramifications from rising tariffs, the impact of the Federal Reserve’s decision to increase the federal funds rate, and a ripple effect from the declines in the stock market.

Federal Reserve Chairman Jerome Powell recounted his thoughts on the economy’s performance at post-meeting press conference on December 19, 2018:

Since September, the U.S. economy has continued to perform well, roughly in line with our expectations. The economy has been adding jobs at a pace that will continue bringing the unemployment rate down over time. Wages have moved up for workers across a wide range of occupations—a welcome development. Inflation has remained low and stable and is ending the year a bit more subdued than most had expected. Although some American families and communities continue to struggle, and some longer-term economic problems remain, the strong economy is benefiting many Americans.

The following table displays a summary of the economic indicators, their performance over the past year, and whether this is viewed as a positive or negative sign for the economy at large. The leading, lagging, and coincident indices were obtained from The Conference Board.

[1] U.S. Department of Commerce, Bureau of Economic Analysis, Gross Domestic Product: Third Quarter 2018 (Third Estimate), December 21, 2018

[2] Federal Reserve Bank of Philadelphia, Third Quarter 2018 Survey of Professional Forecasters, August 10, 2018

[3] U.S. Bureau of Economic Analysis, Population [POPTHM], retrieved from FRED, Federal Reserve Bank of St. Louis, January 2, 2018

[4] Organization for Economic Co-operation and Development, Working Age Population: Aged 15-64: All Persons for the United States [LFWA64TTUSM647N], retrieved from FRED, Federal Reserve Bank of St. Louis, January 2, 2018

[5] U.S. Bureau of Labor Statistics, Civilian Labor Force Participation Rate [CIVPART], retrieved from FRED, Federal Reserve Bank of St. Louis

[6] United States Department of Labor, Bureau of Labor Statistics, The Employment Situation: November 2018, December 7, 2018

[7] Federal Reserve Bank of Philadelphia, Fourth Quarter 2018 Survey of Professional Forecasters, November 13, 2018

[8] United States Department of Labor, Bureau of Labor Statistics, Unemployment Insurance Weekly Claims, December 27, 2018

[9] United States Department of Labor, Bureau of Labor Statistics, Consumer Price Index: November 2018, December 12, 2018

[10] Federal Reserve Bank of St. Louis, Federal Reserve Economic Data, Series: STLPPM, Price Pressures Measure, last accessed January 3, 2019

[11] Federal Reserve Bank of Philadelphia, Fourth Quarter 2018 Survey of Professional Forecasters, November 13, 2018

[12] Federal Reserve Bank of St. Louis, Federal Reserve Economic Data, Series: DTB3MS, 3-Month Treasury Bill: Secondary Market Rate, last accessed January 3, 2019

[13] Federal Reserve Bank of St. Louis, Federal Reserve Economic Data, Series: DGS10, 10-Year Treasury Constant Maturity Rate, last accessed January 3, 2019

[14] Wall Street Journal, Fed Statement Tracker, https://projects.wsj.com/fed-statement-tracker-embed/

[15] Federal Open Market Committee, Summary of Economic Projections, December 19, 2018

[16] Federal Reserve Bank of Atlanta, Market Probability Tracker, last accessed January 3, 2019

[17] Federal Reserve Bank of St. Louis, Federal Reserve Economic Data, Series: DAAA, Moody’s Seasoned Aaa Corporate Bond Yield©, Series: DBAA, Moody’s Seasoned Baa Corporate Bond Yield©, last accessed January 3, 2018

[18] U.S. Department of the Treasury, Daily Treasury Yield Curve Rates, last accessed January 3, 2018

[19] Johansson, Peter, and Andrew Meldrum (2018). “Predicting Recession Probabilities Using the Slope of the Yield Curve,” FEDS Notes. Washington: Board of Governors of the Federal Reserve System, March 1, 2018, https://doi.org/10.17016/2380-7172.2146.

[20] Gilchrist, S., and E. Zakrajšek (2012), “Credit Spreads and Business Cycle Fluctuations,” American Economic Review 102(4), pp. 1692-1720.

[21] U.S. Department of Commerce, Bureau of Economic Analysis, Corporate Profits: Third Quarter 2018, December 21, 2018

[22] Total return indices include returns from both income and capital gains

[23] S&P Capital IQ Database, last accessed January 3, 2019

[24] Federal Reserve Bank of St. Louis, Federal Reserve Economic Data, Series: HOUST, Housing Starts, last accessed January 3, 2019

[25] Federal Reserve Bank of St. Louis, Federal Reserve Economic Data, Series: TTLCONS, Total Construction Spending, Seasonally Adjusted Annual Rate, last accessed January 3, 2019

[26] The Conference Board, Consumer Confidence Index, December 27, 2018

[27] University of Michigan, Surveys of Consumers, December 2018

[28] The Conference Board, The Conference Board Leading Economic Index® (LEI) for the U.S. Increased Slightly in November, December 20, 2018

For more information, contact:

Marty Hanan is the founder and President of ValueScope, Inc., a valuation and financial advisory firm that specializes in valuing assets and businesses and in helping business owners in business transactions and estate planning. Mr. Hanan is a Chartered Financial Analyst and has a B.S. Electrical Engineering from the University of Illinois and an MBA from Loyola University of Chicago.

If you liked this blog you may enjoy reading some of our other blogs here.

Formula One/1 racing returns to Las Vegas this weekend for the first time in over 40 years. The Heineken Silver Las Vegas Grand Prix 2023 is the start of a three-year contract with the city; although Formula 1 intends to support the race for at least 10 years and the entertainment and gaming hub of the U.S. intends on a “lifetime partnership” with the top class of international racing. The nearly four mile track will wind through Las Vegas landmarks, hotels, and casinos with a straightaway section down the famous “Strip” at speeds reaching 212 miles per hour in cars that can range in cost from $12 to $20 million. The Las Vegas Grand Prix is the next to last F1 race on the 2023 circuit.

Formula One/1 racing returns to Las Vegas this weekend for the first time in over 40 years. The Heineken Silver Las Vegas Grand Prix 2023 is the start of a three-year contract with the city; although Formula 1 intends to support the race for at least 10 years and the entertainment and gaming hub of the U.S. intends on a “lifetime partnership” with the top class of international racing. The nearly four mile track will wind through Las Vegas landmarks, hotels, and casinos with a straightaway section down the famous “Strip” at speeds reaching 212 miles per hour in cars that can range in cost from $12 to $20 million. The Las Vegas Grand Prix is the next to last F1 race on the 2023 circuit.

Penn Entertainment (Nasdaq:

Penn Entertainment (Nasdaq:  The Value of X

The Value of X

ValueScope is a leader in the application of financial and economic analysis for measurement of value, litigation support, and aiding growth of shareholder value. Conveniently located between Dallas and Fort Worth, our firm’s single focus is providing quality business valuation and appraisal services.

ValueScope is a leader in the application of financial and economic analysis for measurement of value, litigation support, and aiding growth of shareholder value. Conveniently located between Dallas and Fort Worth, our firm’s single focus is providing quality business valuation and appraisal services.