Oil & Gas Price Outlook September 2016

End of August Supply Concerns

WTI oil prices fell over 3.5% on Wednesday, paring their 20%+ gains in August, based on new supply information from Saudi Arabia and the EIA. Oil prices’ recent gains had been driven by speculation that OPEC and other producers would agree to curb their output, causing prices to reach a high of over $49 per barrel. Oil & Gas Price Outlook September 2016

However, on August 31st, the Saudi Arabian energy minister Khalid al-Falih said that the top crude exporter does not have a specific target figure for its oil production and that its output depends on the needs of its customers.

Also, on the same day the EIA announced that crude stockpiles rose for a second straight week, building by 2.3 million barrels last week, compared with analysts’ expectations for a rise of only 0.9 million barrels. At 525.9 million barrels, U.S. crude oil inventories are at historically high levels for this time of year.1

August Daily Crude Futures Pricing (\CL)

These two announcements contributed to both spot and future’s prices for oil decreasing over $1.50 per barrel on the last day of the month. As of this blog’s posting, oil prices were down another dollar on the first.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future ranges or “confidence intervals” for crude oil and natural gas prices.

The graphic below shows the crude oil price on September 1, 2016 and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the September 1, 2016 prices, the markets indicate that in mid-December, there is about a 68% chance that oil prices will be between $38.00 and $53.50 per barrel. Likewise, there is about a 95% chance that prices will be between $29.00 and $64.00. For a longer-term view, by mid-March 2017, the +/- 1σ price range is $36.50 to $60.50 per barrel.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at about $2.87 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in December 2016, the +/- 1σ price range is $2.65 to $3.85 per MMBTU and the 2σ range is $2.15 to $5.05 per MMBTU. The expected midpoint of natural gas prices is $3.17 for the end of 2016.

- US EIA Weekly Report, CNBC 8/30/16

Tags: Oil & Gas Price Outlook September 2016

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.

To receive updates on our news and blogs.

We will never share your data!

Download a PDF version of this blog by clicking here.

ValueScope’s Oil & Gas Price Outlook: August 2016

Oil & Gas Price Outlook August 2016

Gasoline Prices Not Costing an “Arm and a Leg” This Summer

According to CNBC1, gasoline prices — at $2.16 per gallon nationally — could fall another 10 percent or more, and while that’s good for consumers, it may not be so for stock market investors.

According to CNBC1, gasoline prices — at $2.16 per gallon nationally — could fall another 10 percent or more, and while that’s good for consumers, it may not be so for stock market investors.

That’s because there’s now a glut of gasoline, and that is pressuring oil prices. The oversupply of crude in world markets turned into a product glut this summer, with refiners producing more gasoline and diesel than is needed, even with near-record high demand. According to AAA, the national average for unleaded gasoline is down 15 cents in a month.

![]()

Gasoline futures trade under the symbol RBOB, or Reformulated Gasoline Blendstock for Oxygen Blending (simply the term given to unleaded gas futures). As one would expect, gasoline prices follow oil price movements.

Also, RBOB prices will always be lower than gasoline prices at the pump, since they are measured at a specific delivery point (for the contracts) and their prices do not include transportation fees, storage costs and retail profits.

“These are the cheapest gasoline prices for the end of July since 2004. There’s 36 states where you see gas less than $2 a gallon. The really cheap prices will be between Labor Day and Election Day,” said Tom Kloza, global head of energy analysis at Oil Price Information Services. Kloza expects the national average to fall below $2 per gallon, and said another 10 percent decline could easily be in store.2

Looking at the futures market for RBOB3, it is obvious there is a strong seasonal factor to pricing with the lows being around January of each year, so Kloza’s comments above could pan out as the 2016 Election approaches.

As with all statistical analyses, however, the devil is in the details and it is often difficult to discern between “correlation and causality.”

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future price ranges or “confidence intervals” for crude oil and natural gas. Crude oil prices have dropped by nearly 20% from one month ago, representing a decrease of approximately one standard deviation downward.

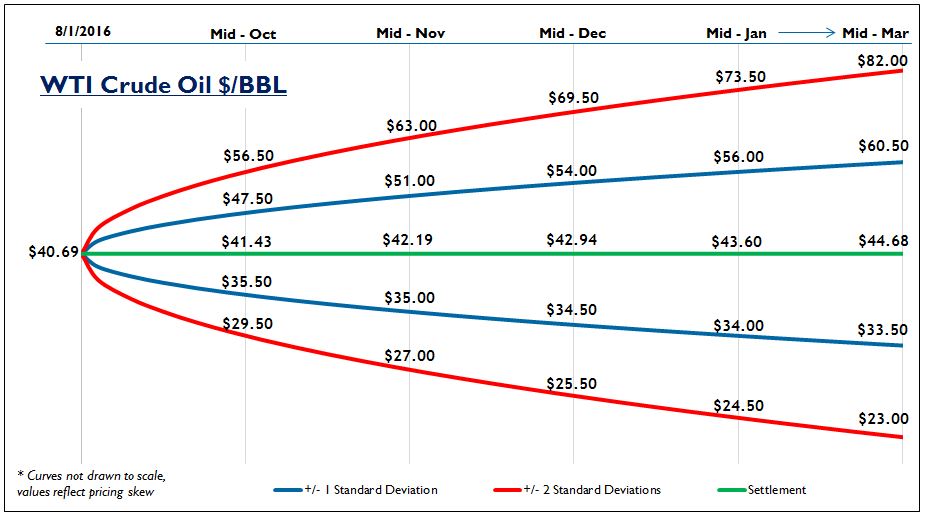

The graphic below shows the crude oil price on August 1, 2016 and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the August 1, 2016 prices, the markets indicate that in mid-October, there is about a 68% chance that oil prices will be between $35.50 and $47.50 per barrel. Likewise, there is about a 95% chance that prices will be between $29.50 and $56.50. For a longer-term view, by mid-December 2016, the +/- 1σ price range is $34.50 to $54.00 per barrel. This upward skew in the price ranges also drives the expected midpoint of $42.94 per barrel at year end.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at about $2.82 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in mid-December 2016, the +/- 1σ price range is $2.65 to $4.15 per MMBTU and the 2σ range is $2.05 to $5.45 per MMBTU. The expected midpoint of natural gas prices is $3.28 for the end of 2016.

-

CNBC.com, July 25, 2016, Patti Domm

-

Ibid.

-

http://www.barchart.com/commodityfutures/Gasoline_Rbob_Futures/RB?search=RB*+

Tags: Oil & Gas Price Outlook August 2016, Oil Price Outlook, Gas Price Outlook, Crude Oil Outlook, Natural Gas Price Outlook, Oil Price Prediction

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.

To receive updates on our news and blogs.

We will never share your data!

ValueScope’s Oil & Gas Price Outlook: July 2016

Oil & Gas Price Outlook July 2016

“Buying Time” Is Expensive for Oilfield Service Companies

ValueScope recently analyzed and provided a fairness opinion for a private equity (“PE”) firm’s subsequent investment in an oilfield service company. Based on our analyses, the service company would violate the EBITDA covenants on its debt in 2017 and would need cash to buy back a portion of its debt. Due to recent market conditions, the company did not have adequate working capital for this and was unable to take on any more bank debt.

Therefore, seeking an additional equity investment was required, versus risking bankruptcy next year. Previously, the existing shareholders had invested at $1.00 per share. A PE firm agreed to invest $100M dollars under the following terms:

- The security would be a preferred security, senior to all other equity classes

- This additional investment would provide allow them to get through the 2017 debt paybacks required

- Capital was also earmarked for a $50M acquisition of assets (at a fraction of their original cost) from another bankrupt service company

In addition to being senior to all other classes of shareholders, the “new money” negotiated for its shares to be valued at 60 cents per share. This price reduced value of existing shareholders in an exit scenario, and gave new money approximately 70% more shares than a value of $1.00, thus creating even more dilution for the existing shareholders.

The good news is that new equity capital is being invested in this market, but it requires tough choices for existing shareholders:

- take a significant valuation haircut now, in exchange for financial flexibility and duration, or

- roll the dice (effectively betting the entire value of their equity) on acquiring a future source of capital under better terms.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future price ranges or “confidence intervals” for crude oil and natural gas.

The graphic below shows the crude oil price on June 30, 2016 and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the June 30, 2016 prices, the markets indicate that in mid-August, there is about a 68% chance that oil prices will be between $37.50 and $62.50 per barrel. Likewise, there is about a 95% chance that prices will be between $32.50 and $75.00. For a longer-term view, by mid-December 2016, the +/- 1σ price range is $38.00 to $79.00 per barrel. This upward skew in the price ranges also drives the expected midpoint of $53.64 per barrel at year end.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at about $2.89 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in mid-December 2016, the +/- 1σ price range is $2.65 to $4.25 per MMBTU and the 2σ range is $2.05 to $5.75 per MMBTU. The expected midpoint of natural gas prices is $3.29 for the end of 2016.

Tags: Oil & Gas Price Outlook July 2016, Oil Price Outlook July 2016, Gas Price Outlook July 2016, Natural Gas Price Outlook, Crude Oil Price Outlook

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.

To receive updates on our news and blogs.

We will never share your data!

ValueScope’s Oil & Gas Price Outlook: June 1, 2016

Oil & Gas Price Outlook June 2016

“Market Gurus” – Worth Following?

Many financial players (investors, bankers, fund managers, etc.) are quoted daily with their view on the markets, predictions for oil and gas prices, etc. For instance, in September 2015, a forecast by Goldman Sachs suggested that oil could tank to $20 per barrel.[1] Fast forward a few months, and in January 2016 Goldman said it was sticking with its $40 per barrel forecast (2X their previous forecast) for the first half of 2016. The investment bank went on to say that it sees a new bull market in oil starting to evolve in late 2016 as market adjustments balance out supply and demand.[2] Curious that Goldman was sticking with a $40 per barrel forecast shortly after  predicting that oil prices would go to $20 per barrel? Oil & Gas Price Outlook June 2016.

predicting that oil prices would go to $20 per barrel? Oil & Gas Price Outlook June 2016.

Another example is that T. Boone Pickens predicted on CNBC’s “Squawk Box” on February 1, 2016 that oil prices will advance to at least $52 per barrel by the end of 2016, saying that U.S crude oil had touched the bottom at $26 per barrel. Nonetheless, just a few days after his interview on “Squawk Box”, the founder of energy-focused BP Capital claimed in a separate interview on “Bloomberg Go” that he had sold out of all of his oil-related holdings and awaits better entry points.[3]

Our point of view is that markets are reasonably efficient and that when market participants invest, they put “their money where their mouth is.” With market gurus making predictions daily, many seem to be doing just the opposite of their advice.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future price ranges or “confidence intervals” for crude oil and natural gas.

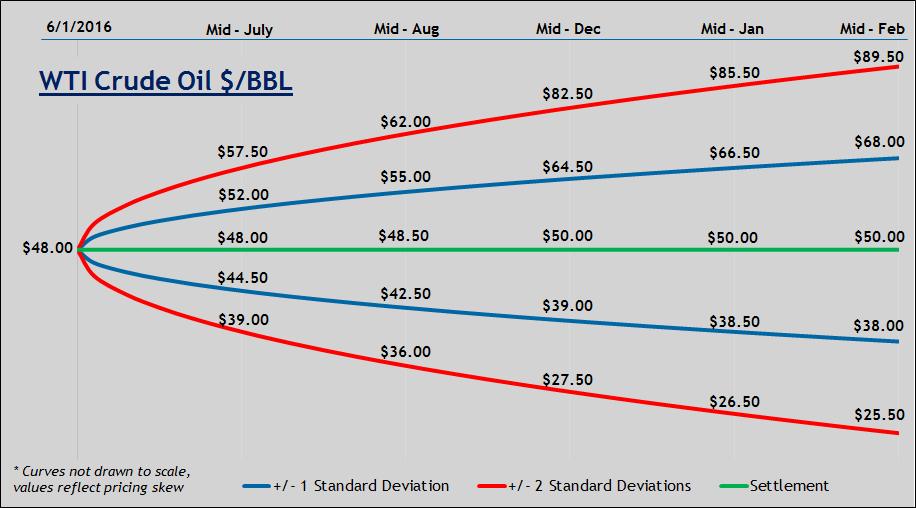

The graphic below shows the crude oil price on June 1, 2016 and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the June 1, 2016 prices, the markets indicate that in mid-August, there is about a 68% chance that oil prices will be between $42.50 and $55.00 per barrel. Likewise, there is about a 95% chance that prices will be between $36.00 and $62.00. For a longer-term view, by mid-December 2016, the +/- 1σ price range is $39.00 to $64.50 per barrel. This upward skew in the price ranges also drives the expected midpoint of $50.00 per barrel at year end.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at about $2.30 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in mid-November 2016, the +/- 1σ price range is $2.15 to $3.45 per MMBTU and the 2σ range is $1.55 to $4.65 per MMBTU. The expected midpoint of natural gas prices is $3.00 for the end of 2016.

Tags: Oil & Gas Price Outlook June 2016, Oil Price Outlook, Gas Price Outlook, Crude Oil Price Outlook, Natural Gas Price Outlook

[1] CNBC September 11, 2015 Interview

[2] OilPrice.com, January 20, 2016

[3] Commodities, Hedge Fund Analysis, February 18, 2016

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.

To receive updates on our news and blogs.

We will never share your data!

ValueScope’s Oil & Gas Price Outlook: May 2, 2016

Oil & Gas Price Outlook May 2016

Market Capitalization’s Impact on MLP Yields and Multiples

Investors and valuation experts have long debated the general magnitude (and even the existence) of a “small stock risk premium” and its effect on market values. Small stock risk implies simply that investors expect a higher rate of return for investments in smaller companies (given a higher perceived level of risk).

A recent research report on Master Limited Partnership (“MLP”) values illustrates this concept and how it plays out in two groups of MLP’s with different size market capitalizations. The “Large Cap MLP Group” reflects companies with market capitalization of more than $3.5 billion. For this group, shown below, their current yield has a median value of 15.1% and the enterprise values are trading at a median of 13.5 times their estimated 2016 EBITDA.

The “Small and Mid-Cap MLP Group” reflects companies with market capitalization less than $3.5 billion. For this group, shown below, their current yield has a median value of 7.3% and the enterprise values are trading at a median of 9.6 times their estimated 2016 EBITDA.

As shown above, the market has priced these securities so that the median yield for the Small and Mid-Cap Group is almost 8% higher that of the larger group. All else equal, an 8% higher distribution rate would imply a higher cost of equity required by the market, which results in lower values. This concept is further supported by the 2016 EBITDA multiple effect shown in the data above. The EBITDA multiples show that investors are willing to pay $13.60 for a single dollar of EBITDA from a large MLP, but only $9.60 for a single dollar of EBITDA from a smaller MLP.

Although the data set above is not robust enough to pass an academic peer review, it does illustrate the market’s perception that bigger is better.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future price ranges or “confidence intervals” for crude oil and natural gas.

The graphic below shows the crude oil price on May 2, 2016 and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the May 2, 2016 prices, the markets indicate that in mid-June, there is about a 68% chance that oil prices will be between $39.00 and $52.50 per barrel. Likewise, there is about a 95% chance that prices will be between $31.50 and $61.50. For a longer-term view, I am also showing the year end ranges, which indicates that by mid-December 2016, the +/- 1σ price range is $35.50 to $64.00 per barrel. This upward skew in the price ranges also drives the expected midpoint of $47.30 per barrel at year end. All in all, it was a great month for oil investors with average futures prices going up around $8.00 per BBL.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at about $2.00 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in mid-December 2016, the +/- 1σ price range is $1.70 to $3.20 per MMBTU and the 2σ range is $1.25 to $4.05 per MMBTU. The expected midpoint of natural gas prices is $3.10 at year end.

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.

To receive updates on our news and blogs.

We will never share your data!

ValueScope’s Oil & Gas Price Outlook: April 4th, 2016

Oil & Gas Price Outlook April 2016

If PUDs are “free,” we may be a buyer at that price!

As E&P companies are releasing their year-end 2015 financials, they all show significant write-offs for the value of their Proved Undeveloped Properties, or “PUDs.” These are driven by their independent engineer’s calculations that many of their PUDs have no value at current prices. As shown below, Chesapeake Energy’s PUDs were written down on average 60% over the 12-months ending December 2015.

Their engineer’s calculations following a standardized discounted cash flow model which, if negative, shows a zero value for the PUD location. The real question is that IF these PUDs are worth zero dollars, then why are so many private equity groups lining up to buy them? The simple answer is called the option value of the PUDs.

Real Options

In general, a financial option gives the holder the right, but not the obligation, to act (or drill in this case). A PUD location can be thought of as a call option, i.e., the holder has the right but not the obligation to drill and produce the hydrocarbons at prevailing commodity prices.

In option terminology, drilling the well is like paying the “strike price” of an option to receive the present value of the future production (analogous to a “stock price”). A simple form of this model is called the Black Scholes model. To make up a simplistic example, let’s say a PUD had an expected value for its production of $3 million and it would cost $4 million to drill, frac and complete. Therefore, the net value of that well is a negative $1 million if drilled at today’s prices.

However, owners have the option to not spend those funds now, and if no volatility in prices were assumed, the option value is zero (versus a negative $1 million). However, considering the volatility of oil and gas prices, the model shows that there is value to this option. In this simplistic example, at an assumed 25% volatility, the PUD would be worth $248,000 and at 50% volatility it would be worth $759,000. So is this a sure thing? Of course not, but optionality has value and PUDs are a classic real option.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future price ranges or “confidence intervals” for crude oil and natural gas.

The graphic below shows the crude oil price on April 4, 2016 and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the April 4, 2016 prices, the markets indicate that in mid-May, there is about a 68% chance that oil prices will be between $33.00 and $39.50 per barrel. Likewise, there is about a 95% chance that prices will be between $28.50 and $43.50. For a longer-term view, I am also showing the year-end ranges, which indicates that by mid-December 2016, the +/- 1σ price range is $30.00 to $58.00 per barrel. This upward skew in the price ranges also drives the expected midpoint of approximately $41.00 per barrel at year end.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at about $2.03 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, six months from now in mid-October 2016, the +/- 1σ price range is $1.75 to $3.05 per MMBTU and the 2σ range is $1.25 to $4.25 per MMBTU.

Tags: Oil & Gas Price Outlook April 2016, Oil Price Outlook, Gas Price Outlook, Natural Gas Price Outlook, Crude Oil Price Outlook

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.

To receive updates on our news and blogs.

We will never share your data!

Your boss hates March Madness….

March Madness Employee Productivity

Are you one of the more than 60 million Americans that filled out a March Madness tournament bracket at work this year? How about one of the 1.5 million employees streaming the NCAA Tournament online and on your company’s dollar? If you fall into either of these categories, you are a contributor to $1.9 billion dollars of productivity costs that business are expected to lose during March Madness this year.

This estimate was made by global outplacement firm Challenger, Gray & Christmas, Inc., is based on the number of working Americans who are likely to be caught up in March  Madness: the estimated time spent streaming games and filling out brackets; and average hourly earnings, which according to the Bureau of Labor and Statistics is at $24.78 in January of this year.

Madness: the estimated time spent streaming games and filling out brackets; and average hourly earnings, which according to the Bureau of Labor and Statistics is at $24.78 in January of this year.

This estimate could actually be lower now that Kentucky and Michigan State have been knocked out of the race but either way many employees will still tune in.

With all of the potential dollars wasted on a lack of productivity during March Madness the question arises: should companies prohibit workplace pools and block access to streaming sites?

The CEO of Challenger, Gray & Christmas says that employers shouldn’t because March Madness is a national tradition and attempting to prevent your employees might actually do more harm than good in the form of employee morale and loyalty.

So now we’re curious, have you spent any time at work filling out a bracket or streaming a game online? Don’t worry, we won’t tell.

Marty Hanan is the founder and President of ValueScope, Inc., a valuation and financial advisory firm that specializes in valuing assets and businesses and in helping business owners in business transactions and estate planning. Mr. Hanan is a Chartered Financial Analyst and has a B.S. Electrical Engineering from the University of Illinois and an MBA from Loyola University of Chicago.

If you liked this blog then you may enjoy reading some of our other blogs here.

To receive updates on our news and blogs.

We will never share your data!

ValueScope’s Oil & Gas Price Outlook: February 2, 2016

Oil & Gas Price Outlook February 2016

A wild ride to expected values!

In our January blog, we showed that futures markets predicted a one-standard deviation range (68% probability) for oil prices was expected to be approximately $33 – $39 per barrel as of month end. The day after we published, oil prices began falling like a snow skier on a double-black diamond slope.

Throughout January, announcements about over-supply, OPEC’s sentiments and Chinese demand rocked the markets, moving below the two standard deviation expectation. However, as of last Friday, the price of WTI settled close to the bottom of the lower one standard deviation price and today it is flirting with the two standard deviation decline.

Bullish on Oil Prices, then buy the S&P500??[1]

As oil prices tumbled early in 2016, global equities recorded one of their worst-ever starts for a new year. In addition to oversupply, traders are now growing concerned that demand may be weakening as well.

Interestingly, year-to-date oil prices and global stock markets have moved almost one for one. The graphic above shows that up and down pricing days for oil and the overall stock market matched almost perfectly. According to the Wall Street Journal, a correlation this high has not been seen in the past 26 years.[2]

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future price ranges, or “confidence intervals”, for crude oil and natural gas.

Based on the February 1, 2016 prices, the markets indicate that in mid-March, there is about a 68% chance that oil prices will be between $26.00 and $41.00 per barrel. Likewise, there is about a 95% chance that prices will be between $19.00 and $53.00. For a longer-term view, I have added a six-month outlook which indicates that by mid-August 2016, the +/- 1σ price range is $28.00 to $57.00 per barrel. [3] This upward skew in the price ranges also drives the expected midpoint of $40.00 per barrel 6-months out.

If there were a positive spin to this data, it would be that currently the market shows an 85% expectation that the price of oil will not drop below $26.00 over the next six months.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at about $2.15 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in mid-August 2016, the +/- 1σ price range is $1.95 to $3.10 per MMBTU and the 2σ range is $1.50 to $3.95 per MMBTU.

-

[1] No part of this blog should be considered a trade recommendation.

-

[2] Wall Street Journal, http://www.wsj.com/articles/oil-stocks-dance-the-bear-market-tango-1453722783

-

[3] Crude oil futures and their options are too thinly traded farther out in time be considered statistically significant.

Tags: Oil & Gas Price Outlook February 2016, Crude Oil Price Outlook, Natural Gas Price Outlook

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog then you may enjoy reading some of our other blogs here.

To receive updates on our news and blogs.

We will never share your data!

ValueScope’s Oil & Gas Price Outlook: January 5, 2016

Happy New Year!

Oil & Gas Price Outlook January 2016

After enduring a 32% drop in crude oil prices and a 35% drop in natural gas prices in 2015, this next year has to improve… doesn’t it??

While futures markets aren’t a crystal ball, with a little bit of statistical analysis, they can tell us what market participants expect. All the information needed is available — we can examine where futures and their option prices are today in order to predict where spot prices will be in the future. This process is useful for estimating future price ranges or “confidence intervals” for crude oil and natural gas, in support of better investment and lending decisions.

Crude Oil Outlook

Take a look at the price distribution below, which shows the crude oil spot price on January 4, 2016 and predicted crude oil prices based on options on oil futures contracts. The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see “Probability & Statistics 101” below).

Based on the January 4, 2016 prices, the markets indicate that in mid-February, there is about a 68% chance that oil prices will be between $33.50 and $40.00 per barrel. Likewise, there is about a 95% chance that prices will be between $29.00 and $45.00.

For a longer-term view, I have added a six-month outlook which indicates that in mid-July 2016, the +/- 1σ price range is $31.00 to $58.00 per barrel and the 2σ range is $23.00 to $80.00 per barrel. In other words, there is a 95% probability that the expected price of oil will be between $23.00 and $80.00 per barrel, and a 97.5% probability it will not be above $80.00 per barrel.

Natural Gas Outlook

We can do the same thing for natural gas, which is currently trading at $2.32 per MMBTU on the Henry Hub. Although more affected by seasonal factors than crude oil, in mid-July 2016, the +/- 1σ price range is $1.95 to $3.20 per MMBTU and the 2σ range is $1.52 to $4.10 per MMBTU.

December 2015 in Review

Crude oil futures ended slightly below the predicted one standard deviation confidence interval at $36.83 per barrel. Key factors moving prices over the last 30 days were inventories and rig counts. OPEC failed to agree on a production ceiling for the first time in decades and predicted that oil prices would be (in real terms) around $70 by 2020 and $95 by 2040. Also driving prices downward was the American Petroleum Institute’s announcement that oil inventories rose by 2.9 million barrels, when analysts surveyed by The Wall Street Journal had forecast a drop in oil inventories of 1.0 million barrels.

Key Takeaways

Remember, these analyses reflect the market’s expected probabilities, not certainty—but that doesn’t make it any less useful. If someone asks when oil might trade at $60 again, you now can respond with “there is about an 85% probability that oil will be below $60 in July 2016.” I know this is nothing to get excited about, but at least now you have some idea of the market’s expectations.

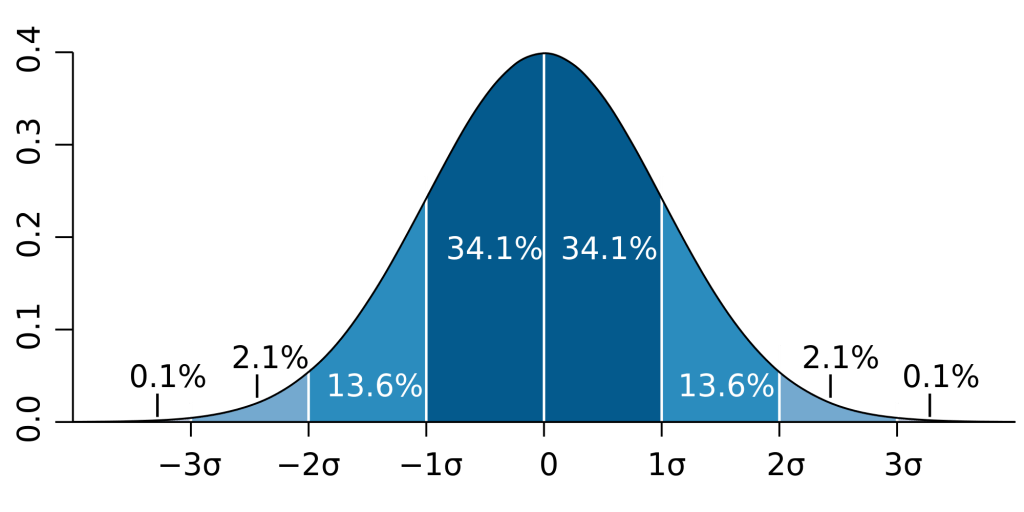

Probability & Statistics 101

Remember the normal curve from your first statistics class? We can use it to determine the probability that future prices will be within a certain range. In a normal distribution, there’s about a 68% chance that a data point lies within one standard deviation of the mean, and about a 95% chance that it lies within two standard deviations.

Analysts and traders use metrics known as option “Greeks” in order to decode the sensitivities of futures and options to price changes. Using option Greeks, we can determine the prices and probabilities that market participants as a whole are expecting. How can we determine the likely behavior of such a large and often unpredictable group? Because investors are already telling us what they expect by voting with their dollars, not just their intuition.

Tags: Oil & Gas Price Outlook January 2016, Crude Oil Price Outlook, Natural Gas Price Outlook

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

ValueScope’s Oil & Gas Price Outlook: December 1, 2015

Oil & Gas Price Outlook December 2015

Don’t rely upon Wall Street soothsayers — if you want to predict the future of oil & gas prices, rely on probabilities and not a crystal ball. For instance, Goldman Sachs recently made headlines when an analyst noted that $20 oil was possible next year. Analysts can run large macroeconomic models to predict such values, but they are all predicated on numerous assumptions. Is there a better source of insight for future oil & gas prices?

While futures markets today can’t determine the future for sure, with a little bit of straightforward statistical analysis, they can tell us what market participants expect. All the information needed is available—we can examine where futures prices are today in order to predict where spot prices will be in a few weeks or months. This process is useful for estimating the future price range of any traded commodity, but it’s very helpful as a barometer for the energy market as a whole.

Crude Oil Outlook

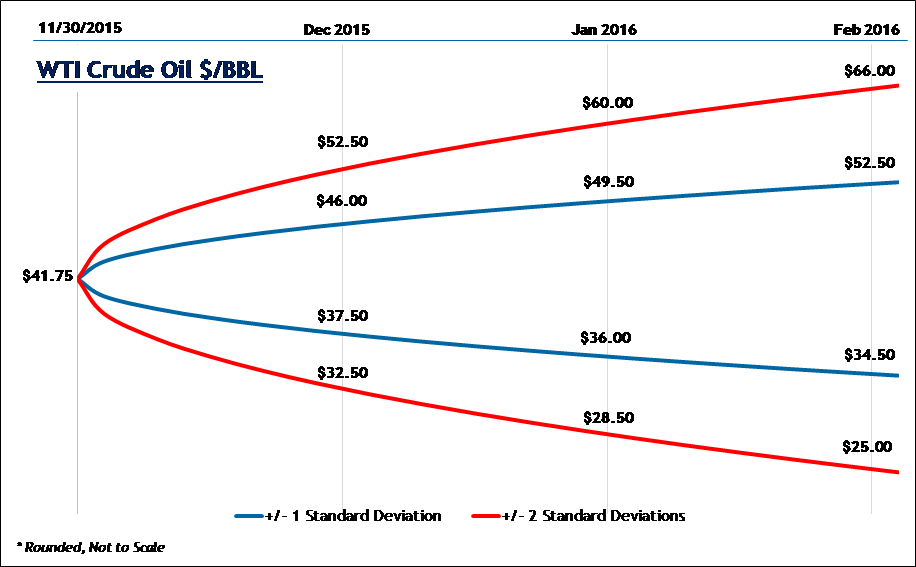

Take a look at the price distribution below, which shows the crude oil spot price on November 30, 2015 and predicted crude oil prices based on option and futures markets. The blue lines are within one standard deviation (σ) of the mean and the red lines are within two standard deviations (for a refresher on standard deviations, see “Probability & Statistics 101” below).

Based on the November 30, 2015 prices, the markets indicate that at year-end there is about a 68% chance that oil prices will be between $37.50 and $46.00 per barrel. Likewise, there is about a 95% chance that prices will be between $32.50 and $52.50. At the end of February 2016, the +/- 1σ price range is $34.50 to $52.50 per barrel and the 2σ range is $25.00 to $66.00 per barrel. In other words, there is a 95% probability that the expected price of oil will be between $25 and $66 per barrel, and a 97.5% probability it will not be above $66 per barrel.

Natural Gas Outlook

We can do the same thing for natural gas, which is currently trading at $2.25 per MMBTU on the Henry Hub. Although more affected by seasonal factors than crude oil, at the end of February 2016, the +/- 1σ price range is $1.95–$2.80 per barrel (68% probability) and the +/- 2σ range is $1.30 to $3.70 per MMBTU (95% probability).

Key Takeaways

Remember, these analyses deal in expected probabilities, not certainty—but that doesn’t make it any less useful. If someone asks you longingly if oil will be at $75 again soon, you now can respond with “there is about a 97.5% probability that oil prices aren’t expected to get above $66 before the end of February 2016, so I wouldn’t count on it.” Likewise, if you’re a banker whose borrower needs at least $3.50 natural gas prices in order to meet their debt service obligations in early 2016, the fact that there’s about a 95% chance that gas prices will be lower than this number should help you make a more informed decision— no black magic required.

Probability & Statistics 101

Remember the normal curve from your first statistics class? We can use it to determine the probability that future prices will be within a certain range. In a normal distribution, there’s about a 68% chance that a data point lies within one standard deviation of the mean, and about a 95% chance that it lies within two standard deviations.

Analysts and traders use metrics known as option Greeks in order to decode the sensitivities of futures and options to price changes. Using option Greeks, we can determine the prices and probabilities that market participants as a whole are expecting. How can we determine the likely behavior of such a large and often unpredictable group? Because investors are already telling us what they expect by voting with their dollars, not just their intuition.

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.