Drilling Rigs’ Day Rates Pricing

According to a recent Bank of America Merrill Lynch research report,1 “High-spec” day rates have remained flat for two months. The term “High-spec” refers to rigs with powerful top drives, hoisting systems and pumps. According to industry sources, rigs with larger (+1,000) horsepower ratings account for an estimated 60 percent of the active rig fleet.

According to a recent Bank of America Merrill Lynch research report,1 “High-spec” day rates have remained flat for two months. The term “High-spec” refers to rigs with powerful top drives, hoisting systems and pumps. According to industry sources, rigs with larger (+1,000) horsepower ratings account for an estimated 60 percent of the active rig fleet.

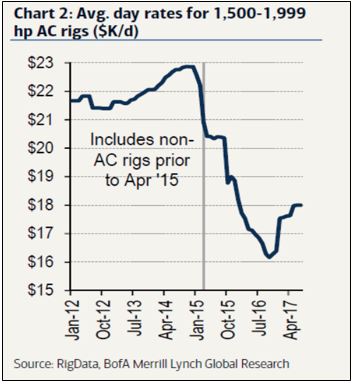

The average day rate for AC-drive 1,500-1,999hp rigs were largely unchanged at $17,999/d in July from $17,996/d in June and $17,977/d in May. When asked about the day rate outlook over the next six months, nearly half of respondents saw no change in pricing, based on sub-$50 oil prices, while 16% forecast a 5-10% increase by year-end. The remaining 35% were uncertain about where day rates were headed. Spot work continued to dominate, representing 79% of all work by surveyed drillers, unchanged from June. Long-term contracts only represented 3% of total work, down from 9% in June, while multi-well contracts rose to 18% from 12% in June.2

Six Month Oil Price Review

The downward trend in oil prices has continued over the past six months. As shown in the chart below, oil futures (\CL) have traded within an approximate $7.50 band, trending downward to today’s price of approximately $47.00 per BBL.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future ranges, or “confidence intervals,” for crude oil and natural gas prices.

The graphic below shows crude oil price as of August 15, 2017 and predicted crude oil prices based on options on oil futures contracts (ticker /CL).

On the graphic below, the blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on August 15, 2017 option prices, the futures markets indicate that in mid-October 2017 there is about a 68% chance that oil prices will be between $42.00 and $53.50 per barrel. Likewise, there is about a 95% chance that prices will be between $35.00 and $61.00. For a longer-term view, by mid-January 2018 the +/- one standard deviation price range is between $39 to $63 per barrel with an expected value of $48.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at $2.95 per MMBtu on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in October 2017, the +/- 1σ price range is $2.65 to $3.45 per MMBtu, and the 2σ range (95%) is $2.25 to $4.15 per MMBTU. The expected value of natural gas prices in mid-December 2017 is $3.28 per MMBTU.

1. Bank of America Merrill Lynch: “Land Drillers Sentiment deteriorates in July survey, day rates hold their ground,” Industry Overview, Equity | 08 August 2017

2. American Oil and Gas Reporter, Digital Magazine, Monday, August 14, 2017

Tags: Oil & Gas Price Outlook August 2017, Gas Price Outlook August 2017, Oil Price Outlook August 2017

For more information, contact:

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.