Better Apart?

How Companies Can Create Value through Spinoffs & Divestitures

Recently General Electric (GE) made headlines over its plan to divide the company into three separate companies focusing on healthcare, aviation, and energy1. The conglomerate has operated for over 150 years in multiple industries and is often regarded as the textbook example for how companies can diversify revenue, decrease risk, and increase value through mergers & acquisitions. However, GE’s stock rose significantly in the trading session following their split-up announcement. This raises the question: if the conglomerate model helps increase value to shareholders, then how can a subsequent spinoff also generate value?

Companies can oftentimes generate value for shareholders by divesting its business entities. The value creation typically comes from a lift in valuation multiples that only a pure play company can realize. For example, over the past few years, materials conglomerate DowDuPont has spun its company off into three specialized entities, Dow Chemical, Corteva Agriscience, and DuPont de Nemours. Markets are often willing to apply a “pure play premium” to companies with a singular business line, contrary to how markets often use a “conglomerate discount” when analyzing diversified companies. This stems from investors being able to directly choose and control their exposure to isolated industry risk and return profiles.

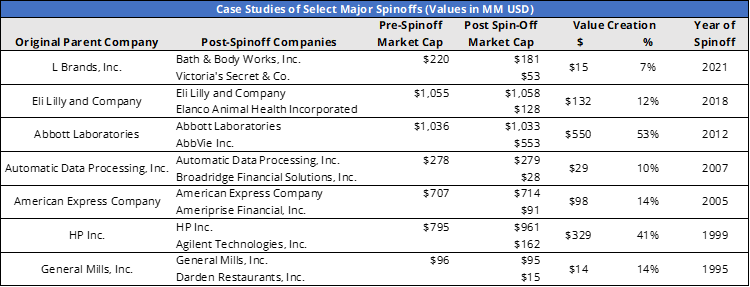

As show in the table below, a brief analysis of several major spinoffs shows that there is potentially significant value in divesting business units. Value creation was estimated by comparing the pre-spinoff market capitalization of the original parent company with the combined post-spinoff market capitalizations of the companies that have been spun off.

1 https://www.ge.com/news/reports/ge-announces-plans-to-form-three-public-companies

L Brands recently spun off the struggling lingerie retailer Victoria’s Secret to focus on the thriving home goods and personal care product retailer Bath and Body Works.

Eli Lilly spun off Elanco Animal Sciences, a veterinary health company, to capitalize on strong investor demand and higher valuation multiples.

Abbott Laboratories spun off its branded pharmaceutical portfolio into the company now known as AbbVie. This divestiture allowed investors to better control their risk exposure by investing in a medical products business and a separate pharmaceutical company.

American Express spun off their financial advising business and renamed it Ameriprise Financial in 2005 amidst allegations of defrauding wealth management clients and poor asset management performance. Asset managers are also typically valued based on their assets whereas payment processing and credit card issuers are valued based on revenue and profitability.

Hewlett Packard split up into HP which is a consumer and business electronics producer and Agilent which is a life science instrument producer and laboratory supplier. These businesses have very different valuation multiples and associated industry risk. They would later spinoff HP Enterprises which provides data processing, storage, communications services, and information technology consulting to businesses.

General Mills spun off Darden Restaurants, the parent company of Olive Garden and other casual sit-down eateries, to focus on its core consumer product brand portfolio.

An important consideration of companies considering spinning off a business unit is tax implications. Under tax code sections 355 and 368, companies in the United States are not required to pay taxes on the increased value resulting from a spinoff where shareholders exchange stock as opposed to a sale of the business unit where the company receives cash and realizes capital gains.

While diseconomies of scale and market preferences are the main drivers of most spinoffs, companies are sometime influenced by other factors as well. Sometimes it’s to separate the core brand from bad publicity. Halliburton spun off construction company Kellogg Brown & Root (KBR) after several major controversies regarding their infrastructure contracts in the Middle East during the Iraq war. Companies also divest struggling or distressed business units to lower the cost of capital for its thriving segments.

Diversified companies seeking to maximize firm value and shareholder returns may want to consider a divestiture of their non-core business units to fully realize their value.

About ValueScope

ValueScope is a consulting firm headquartered in the Dallas-Fort Worth metroplex dedicated to helping clients measure, defend, and create value. Our transaction advisory work includes sell side and buy side analysis, buy-sell agreements, divestitures, restructures, quality of earnings analysis, purchase price allocations, and shareholder matters. We conduct comprehensive data analytics to assess value and synergies and our team assists on all stages of a deal’s lifecycle.

About the Author

Mr. Hoelscher has worked in the financial consulting and professional services industry for over 5 years where he has gained valuable knowledge in financial analysis, research, consulting, valuation modeling, and investment management. As a Senior Associate at ValueScope, Mr. Hoelscher assists the ValueScope team in advising clients on mergers and acquisitions, litigation support, valuations of various assets, capital markets advisory, and financial consulting services. Transactions have included leveraged buyouts, restructures, mergers, acquisitions, capital raising, and direct investments. The clients Mr. Hoelscher has assisted operate in a variety of industries including financial services, food & beverage, lodging & hospitality, manufacturing, industrial services, commercial real estate, oil & gas, and healthcare. Mr. Hoelscher received his MBA from Texas Christian University and earned his BBA in Finance from the University of Texas – Arlington.

Contact Us

Phone: (817) 481-4995

E-Mail: info@valuescopeinc.com

The information presented here is not nor should it be treated as investment, financial, or tax advice and is not intended to be used to make investment decisions.