When Tariffs Talk, Markets Tremble: Now May Be The Best Time to Gift

By: Michael Conroy, CFA, and David Kennedy, MFM

The Issue at Hand

It has been a rough few weeks with the recent declines in the stock market and the impending tariffs being placed on imports. However, there may be a silver lining for people who intend to gift in the near future. The recent decline in market valuations provides an opportunity to gift at lower values. This would potentially allow you to gift assets using your lifetime exemption that would have otherwise resulted in a taxable event before the market decline. Given the additional uncertainty with the pending tax legislation, now may be the best time to gift closely held assets.

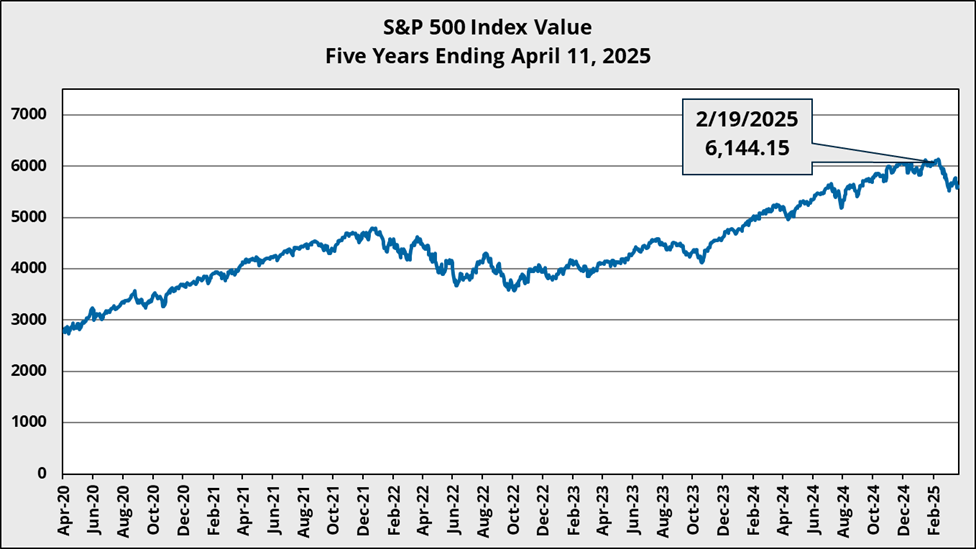

U.S. Stock Market Value Over the Past Five Years

From April 9, 2020, through February 19, 2025, the S&P 500 increased from 2,789.82 to 6144.15, 120.2% return excluding dividends.[1] Between February 19, 2025, and April 7, 2025, the S&P 500 decreased by 18.0% to 5,062.25. The market decline over the last six weeks decreased the total return over the five

year period ending April 11, 2025, to just 92.2%.[2] The following chart shows the S&P 500’s value over the five-year period ending April 11, 2025.

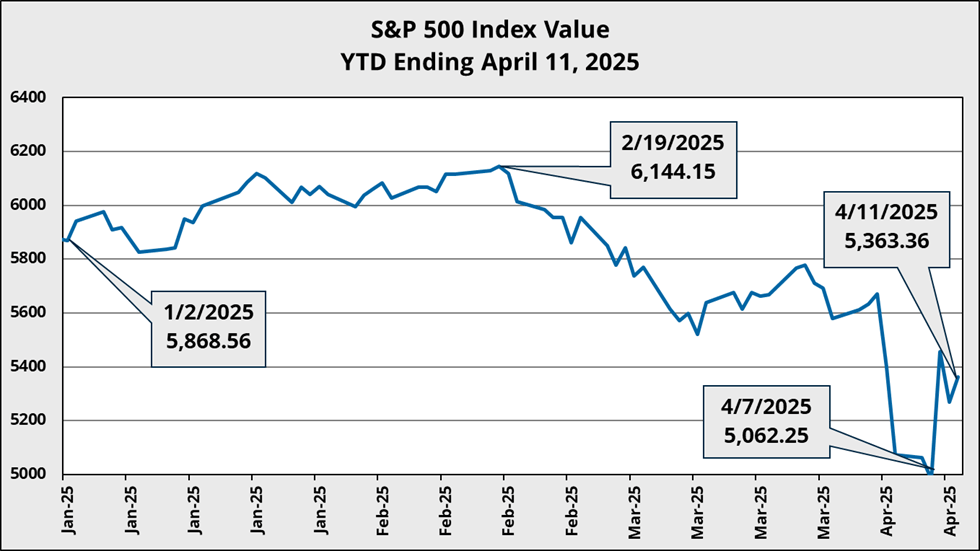

Looking at the performance of the stock market this year, we see a decline of 8.6% year-to-date through April 11, 2025. However, the year did not start out that way. From January 2, 2025, to February 19, 2025, the S&P 500 increased from 5,868.56 to 6,144.15. This gain of 4.70% set a new high for the S&P 500. The index then fell to 5,062.25 as of April 7, 2025, showing a decline of 18.0%. The chart below shows the S&P 500’s value year-to-date through April 11, 2025.

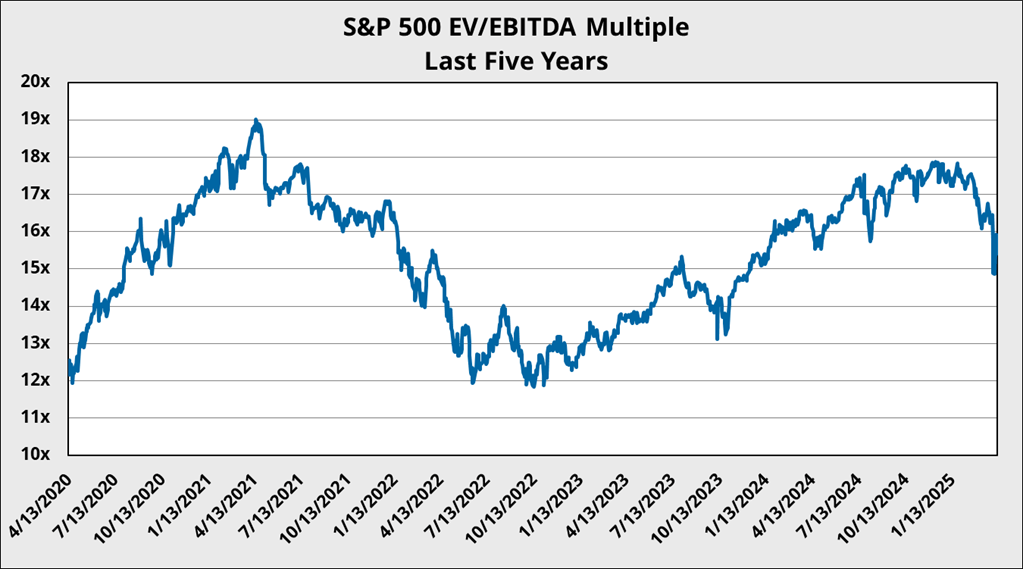

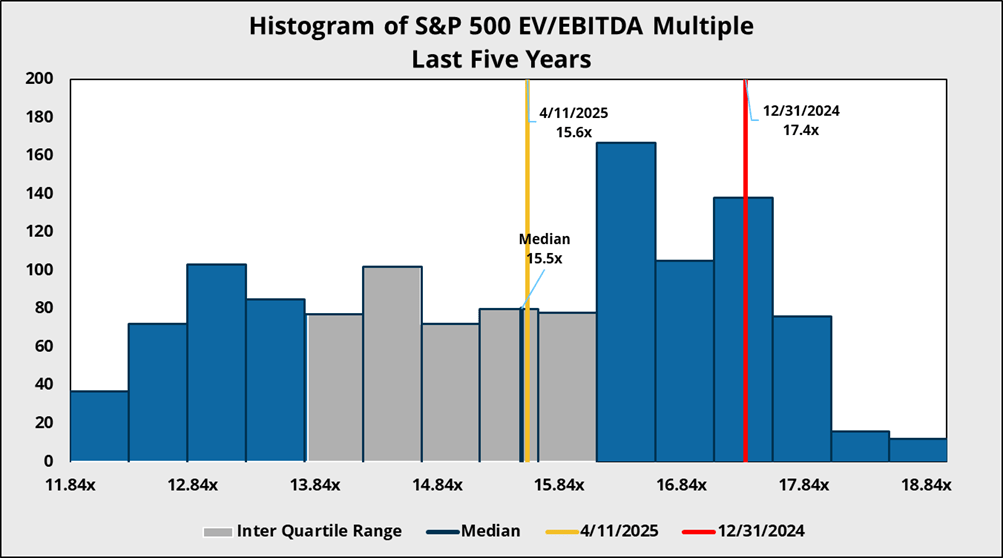

Enterprise Value to EBITDA (EV/EBITDA) Multiples Over the Last Five Years

From April 13, 2020, through February 19, 2025,[1] the Enterprise Value (EV) to EBITDA[2] multiple for the S&P 500 increased from 12.28x to 17.33x, showing an overall increase of 41.09%.[3] Between February 19, 2025, and April 11, 2025, the EV/EBITDA multiple decreased by 10.08% to a value of 15.58x. The following chart shows the S&P 500’s EV/EBITDA multiple over the five-year period ending April 11, 2025.

The EV/EBITDA multiple at the end of last year was 17.36x, which was in the 97th percentile of the EV/EBITDA multiple distribution over the last five years. The recent value of 15.58x on April 11, 2025, is slightly above the median multiple. The following chart shows the distribution of the S&P 500’s EV/EBITDA multiple between April13, 2020 and April 11, 2025.

The dramatic decline in valuation multiples from December 31, 2024, to April 11, 2025, can be seen across all the major valuation multiples. You see this in EV/Revenue, EV/EBIT, P/E, and P/BV, as well as across all of the industry sectors of the S&P 500. Appendix A contains the major valuation multiples for the S&P 500 and its industry sectors as of December 31, 2024. Additionally, it shows the rank of the industry sectors based on each valuation multiple. Appendix B contains the same information as of April 11, 2025.

Appendix C shows the percentage change in the valuation multiples from December 31, 2024, to April 11, 2025, as well as the rank of the industry sectors based on largest decline in each valuation multiple. The IT Sector had the largest decline in all multiples, except for price to earnings (P/E) and Price to Tangible Book Value (Price/Tang BV), where the Telecom & IT Sector had the largest decrease. The Consumer Discretionary Sector saw the next largest decline in valuation multiples. The Energy sector saw the smallest decline in valuation multiples, while the Consumer Staples sector saw an increase in valuation multiples.

How ValueScope Can Assist in Gifting

ValueScope’s estate and gift tax services are used by hundreds of clients each year. We routinely value closely held corporations, family limited partnerships (FLPs), LLCs, stock options, and restricted stock. Fair market values are determined following the IRS’s Revenue Ruling 59-60 as well as industry standards including USPAP and SSVS. ValueScope has extensive experience in:

- Valuations of closely held interests

- Discount studies related to discounts for lack of control, lack of marketability, and built-in gains discounts

- Hard-to-value assets such as GRATs, undivided interests in real estate, stock options, and restricted stock for transfer purposes

ValueScope’s professionals have the experience and credentials to support key valuation positions for tax matters. Our team of experts have given adept testimony in federal income tax and estate matters. Additionally, our balanced approach of working with the Internal Revenue Service, the Department of Justice, and numerous taxpayers provides an opinion that is credible and supportable to triers of fact.

Conclusion

The significant recent decline in valuation multiples provides an opportunity to gift assets at lower values than previously possible. Given the additional uncertainty surrounding the recent tariffs and what may happen to the estate and gift tax exemption levels, it may very well be an opportune time to gift.