Strategic Estate Planning: Protect What You've Built, Pass on What Matters

Current Gift Tax Regulations are Set to Expire at the End of 2025 Leading to a Nearly 50% Reduction in the Lifetime Exemption Level

By: Mike Conroy, CFA, and Andrew Pearson

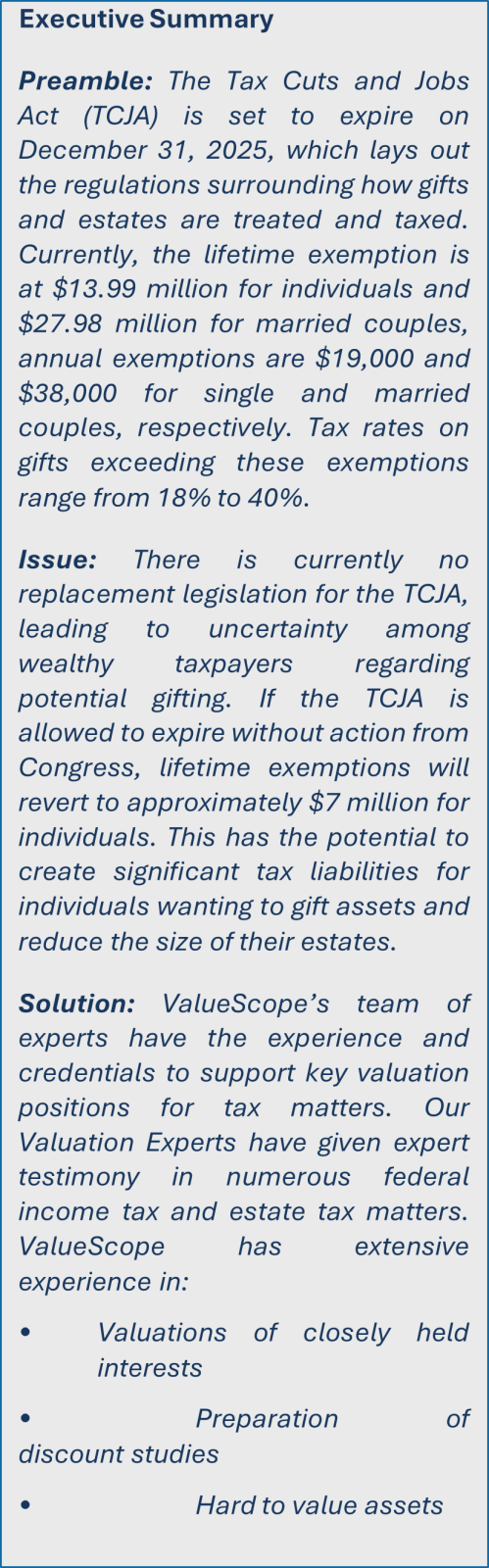

The Issue at Hand

The lifetime gift tax exemption allows individuals to transfer a certain amount of money, property, or other assets without incurring a gift tax. This exemption has changed over time due to modifications in tax laws and economic policy shifts. The most recent change came from the Tax Cuts and Jobs Act of 2017 (TCJA) which increased the lifetime exemption amount to $13.99 million for individuals and $27.98 million for married couples in 2025. In addition to the lifetime exemption, there is an annual exemption set at $19,000 per individual and $38,000 per married couple. A lifetime exemption allows individuals to avoid paying gift and estate taxes for any amount below the exemption level, only suffering tax liabilities on any excess amount over the exemption level. The exemption created by the TCJA was significantly increased from prior levels, making it favorable for individual taxpayers. Taxpayers were less likely to pay taxes upon the gifting of assets from their estate, allowing more of the benefits to be passed down to the recipient.

Unless Congress acts, the TCJA provisions will expire on December 31, 2025. This would cut the lifetime exemption nearly in half, to approximately $7 million. Large estates would be impacted and may have as much as a 40% tax on value exceeding the $7 million lifetime exemption. To put it in perspective, consider an estate valued at $11 million, if the owner wishes to gift now, they will have no tax liability (assuming no prior usage of the lifetime exemption). If they wait until 2026, they could face $4 million in taxable value and be subject to an approximate $1.5 million tax liability! It is imperative that taxpayers act quickly to take advantage of the favorable gift and estate tax exemption.

How Gift and Estate Tax Works

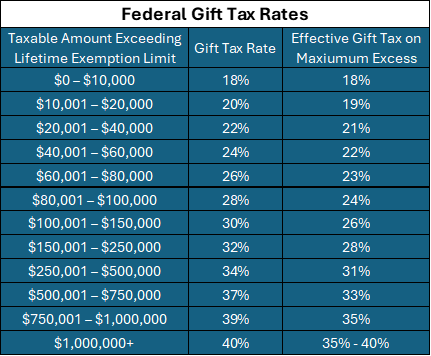

Gift and estate taxes are federal taxes imposed on the transfer of wealth, either during a person’s lifetime (gift tax) or upon their death (estate tax). Gift and Estate tax rates and exemptions are set by the U.S. Federal Government through legislation passed by Congress. A person is liable to pay tax on any transfer of wealth that exceeds their lifetime exemption. Tax rates range from 18% to 40%, depending on the amount transferred. The potential tax liability typically falls on the giver of the gift or the estate, not the recipient.

Both tax rates and exemptions (annual and lifetime), have varied significantly throughout history. In some periods these figures changed annually, while other times they’ve remained stagnant for decades at a time. To showcase the volatility in policy, when the modern U.S. estate tax policy was first enacted in 1916, the exemption was $50,000 and any excess value was taxed at a range of 1-10%, this compares to a tax rate on estate transfers of 77% during World War II, 25 years later[1]. This historical volatility highlights the importance of taking advantage of favorable laws while they are in effect.

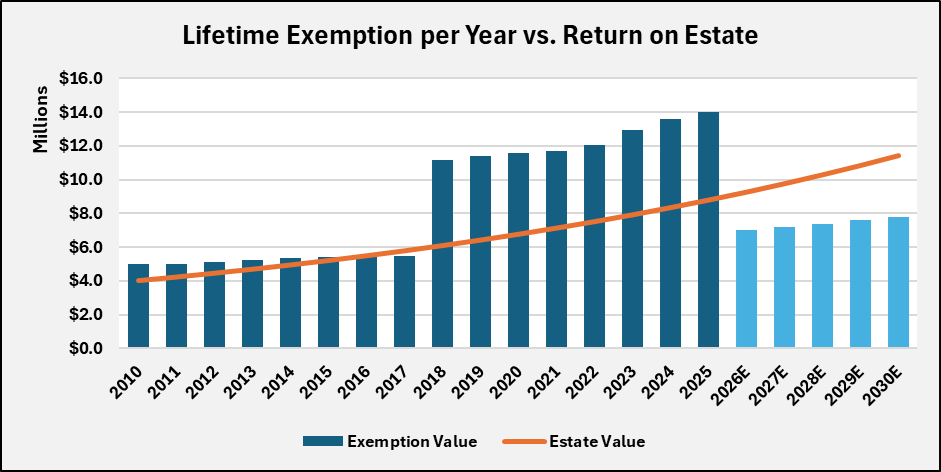

The magnitude of a policy shift resulting in the potential expiration of the TCJA without amendment would see lifetime exemptions fall drastically to approximately $7 million. This would expose many wealthy estates to significant tax liability. For example, if an estate worth $4 million in 2010 grew at an inflation-adjusted rate of return of 5.40%year over year, the value of the estate would put it into taxable territory if the transfer was conducted after the TCJA expired. The tax liability generated from this transfer would be approximately $1.3 million if it were to be gifted in 2030. The tax liability would be calculated based on the expected estate value of $11.5 million less than the $7.8 million estimated lifetime exemption in 2030. The same estate being transferred in 2024 or 2025 would have a tax liability of $0 due to the current favorable gift tax exemption levels.

[1] IRS.gov: The Estate Tax: Ninety Years and Counting

Risks Associated with Lifetime Gift Tax Changes

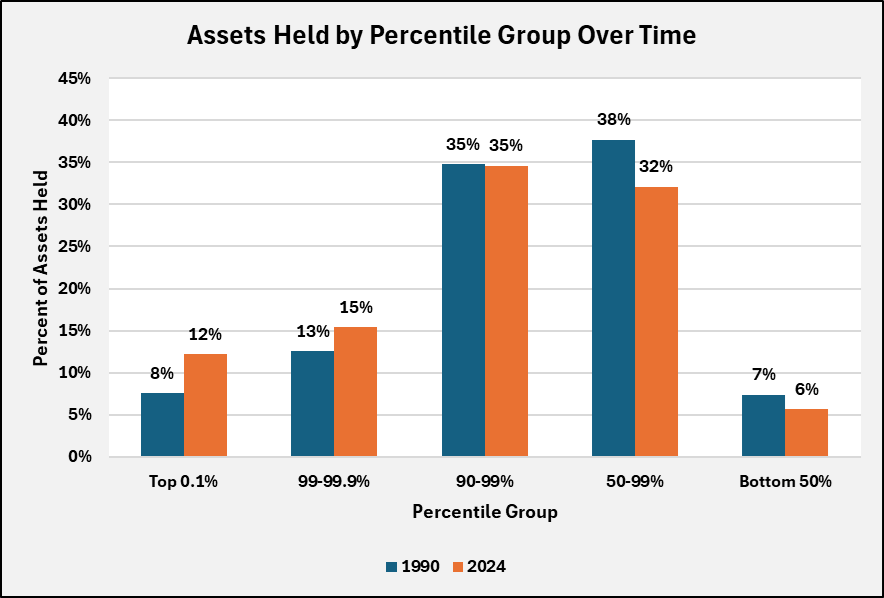

At this point there has been little guidance on what Congress will decide to do regarding the expiration of the TCJA. If Congress attempts to extend or increase the lifetime gift tax exemption, many political challenges will need to be considered. In the face of an ever-expanding government deficit and calls for action on the federal budget, leaving the lifetime gift tax exemption at an elevated rate could exacerbate the issue facing the government and may prompt opposition from those advocating for austerity measures (reduction in the government budget deficit). In addition, leaving the lifetime exemption at a similar or higher level may be viewed as disproportionately benefiting those with large estates, who can fully utilize the multi-million-dollar exemption. In contrast, most Americans do not have taxable estates and are unlikely to be affected by a decrease in the exemption level to $7 million, as they may never reach that exemption level anyway.

How Gifts Are Taxed

The way the current gift tax policy is structured, you pay zero taxes until you exceed both your lifetime and annual exemption. However, once a gift is made that exceeds these limits, the remaining value is subject to federal gift tax. A gift tax rate of 18% applies to gifts exceeding the lifetime exemption limit by no more than $10,000. After that, the tax rate the individual pays are progressive, that is, it increases as the amount in excess of the exemption limit increases. The individual only pays the stated gift tax rate for the value that exceeds the amount of the prior gift tax bracket.

For instance, suppose an individual gifts $40,000 in excess of their applicable exemption limits. As shown on the chart below, the individual pays an 18% gift tax on the first $10,000, 20% on the next $10,000 in value, and 22% on the final $20,000 in value, leading to an effective gift tax rate of approximately 21% on the $40,000 excess value gifted.

A simple example of this is a single individual (who has never gifted more than their annual exemption before) who decides to gift assets to a close friend in 2025. The fair market value of the gifted assets is determined to be $15 million by an independent appraiser. As mentioned above, according to TCJA, the lifetime exemption for a single individual is $13.99 million and their annual exemption is $19,000. The gift therefore exceeds the exemption limits and will be taxed according to the amount that it exceeds. In order to calculate the tax liability associated with this gift, you subtract both exemption amounts (lifetime and annual) combined from the gift value, and then you apply the effective tax rate associated with the taxable amount (approximately 34%).

Now, let’s say for instance the same individual waits until 2026 to gift assets with a fair market value of $15 million. Assuming gift tax rates remain unchanged, and the exemption levels expire without amendment, declining to approximately $7 million, the individual would be liable for significantly more federal gift tax. Following the same process as before reveals not only does the individual have a higher taxable amount but also draws a higher effective tax rate (approximately 39%).

The impact of waiting two years to make this gift cost the donor an additional tax liability of approximately $2.8 million!

Why It’s Important to Start Planning Now!

When it comes to securing your legacy and protecting your loved ones, timing is critical. Gift and estate planning isn’t just for the wealthy or elderly, but it’s a vital step for anyone who wants to ensure their assets are distributed according to their wishes, reduce tax burdens, and avoid legal complications. Beginning the process now allows for greater flexibility, more strategic options, and peace of mind for both you and your family.

There are two key reasons to act sooner rather than later:

Utilize the locked-in higher exemption levels before the exemptions possibly decline approximately 50% beginning in 2026

Ensure timely access to valuation services by acting before the year-end demand spike.

As previously mentioned, for wealthy individuals, a potential change in exemption levels can reduce the value of the assets intended to be gifted to another party; these costs are borne by the donor. Timing should also be considered when determining when to gift assets away. Demand for valuation services will likely surge as the expiration date approaches. This increased demand may overwhelm service providers and attorneys, causing delays and higher costs.

Potential Future Outcomes

The TCJA is set to expire on December 31, 2025. President Trump has expressed a strong desire to extend the tax cuts his administration passed in 2017; however, extending or making the TCJA permanent requires congressional approval. In April 2025, the House of Representatives approved a Senate-passed budget outline with a 216-214 vote, laying the groundwork for a reconciliation bill. This bill must once again be passed by both the House and Senate before it can be sent to the President’s desk to be signed into law. The approved budget outline, dubbed President Trump’s “big, beautiful bill,” includes legislation addressing the following:

- Tax cuts

- Military spending

- Energy policy

- Border security investments

- Raising the debt ceiling

- Many other items

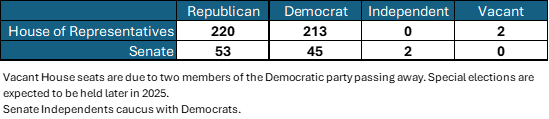

The bill will only require a simple majority of votes in each chamber of the Legislative branch due to the budget outline being passed (if the budget outline had not been passed, a filibuster vote requiring at least 60 votes in the senate would be required). The Vice-President may cast the tie breaking vote in the Senate if necessary. The current make-up of Congress is presented below:

Given a likely unified Democratic resistance to a Republican-led bill, Republicans can afford to lose three votes in both the House and Senate while still maintaining the minimum number of votes required to have a simple majority. The budget outline passed with a 216-214 vote in the House and a 51-48 vote in the Senate. In both chambers, two Republican members voted against it. Despite its passage, at least a dozen additional Republicans have expressed firm opposition to the final draft unless it included deeper spending cuts.

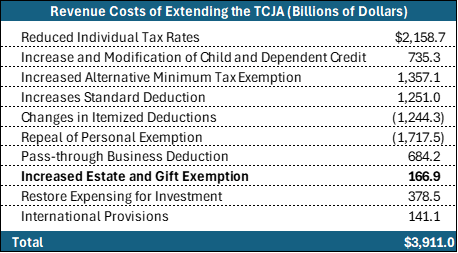

The complexity of the bill, combined with concerns about how the U.S. government will offset reduced tax revenue while managing a growing federal deficit, has raised doubts about its prospects. Many lawmakers continue to prioritize deficit reduction. If the TCJA extended to is 2034, the Joint Committee on Taxation (JCT), a nonpartisan committee of the United States Congress, estimates the cost to the federal government would be $4 trillion. In addition, the JCT estimates that extending the current gift tax exemption policies would cost approximately $167 billion over that same period.[1] Furthermore, the Tax Policy Center, an independently run organization, further estimates that households earning $450,000 or more would receive 45% of the benefits from extending key provisions of the TCJA.[2]

[1] https://www.congress.gov/crs-product/R48286

[2] https://taxpolicycenter.org/taxvox/those-making-450000-and-would-get-nearly-half-benefit-extending-tcja

Another development, still in its early stages, is that President Trump and other lawmakers have expressed openness to raising taxes on the highest-earning Americans. This effort is aimed at reducing the budget deficit and addressing concerns about the distributional effects of current tax policies. This shift could influence how lawmakers approach the TCJA as its scheduled sunset draws near.

There are three broad outcomes that may occur as the TCJA approaches expiration at the end of the year:

- The TCJA becomes permanent or temporarily extended.

Key provisions, such as the historically high federal gift and estate tax exemptions, would remain in place. This would enable individuals and families to continue leveraging the elevated lifetime exemption amount, currently nearly $14 million, for wealth transfers and long-term estate planning without facing immediate tax consequences.

- The TCJA is allowed to sunset and expire.

In this case, the tax code would largely revert to pre-2017 levels. In this scenario, the lifetime gift and estate tax exemption would be reduced by roughly 50%, potentially exposing a significantly larger number of estates to a tax liability. The expiration could also shift the policy landscape, paving the way for a new generation of tax reforms. These might include targeted relief for lower- and middle-income households, such as making tips tax-free and exempting Social Security and overtime wages from federal income tax.

- Congress may pursue a hybrid approach.

Lawmakers could allow certain provisions of the TCJA that favor high-income earners, like the gift tax exemptions, to expire while providing more benefits to lower- and middle-income households, such as those described above.

How ValueScope Can Assist in Gifting

ValueScope’s estate and gift tax services are utilized by hundreds of clients each year. We routinely value closely held corporations, family limited partnerships (FLPs), LLCs, stock options, and restricted stock. All fair market values are determined in accordance with the IRS’s Revenue Ruling 59-60, as well as industry standards including USPAP and SSVS. ValueScope has extensive experience in:

- Valuations of closely held interests

- Discount studies related to discounts for lack of control, lack of marketability, and built-in gains discounts

- Hard-to-value assets such as GRATs, undivided interests in real estate, stock options, and restricted stock for transfer purposes

ValueScope’s professionals possess the experience and credentials necessary to support key valuation positions for tax matters. We have provided expert testimony in federal income tax and estate matters. Additionally, our balanced approach of working with the Internal Revenue Service, the Department of Justice, and numerous taxpayers ensures that our opinions are both credible and supportable in front of triers of fact.

In conclusion, the impending expiration of the elevated lifetime exemption presents both opportunities and challenges. Proactive planning and leveraging expert services, like those provided by ValueScope can help navigate these complexities and maximize the benefits of current tax laws.