Possible Changes to Valuation Discount Rules are Unlikely

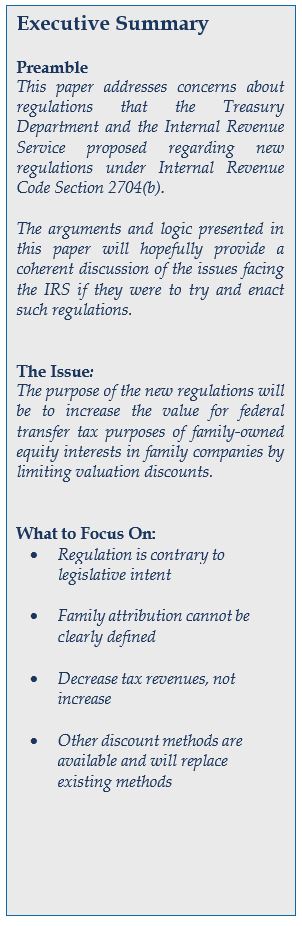

This paper highlights the arguments and logic concerning REG-163113-02 (the “Regulations”) that the Treasury Department and the Internal Revenue Service new regulations under Internal Revenue Code Section 2704(b) similar to those titled “Rules to Modify Valuation Discounts,” which the Administration (IRS/Treasury Department) last proposed in 2013. For the many reasons set forth below, that such regulation, if issued in this form, would be invalid, and in our opinion ineffective.

This paper highlights the arguments and logic concerning REG-163113-02 (the “Regulations”) that the Treasury Department and the Internal Revenue Service new regulations under Internal Revenue Code Section 2704(b) similar to those titled “Rules to Modify Valuation Discounts,” which the Administration (IRS/Treasury Department) last proposed in 2013. For the many reasons set forth below, that such regulation, if issued in this form, would be invalid, and in our opinion ineffective.

The Issue at Hand

The Regulations suggest that the purpose of the new regulations will be to increase the value for federal transfer tax purposes of family-owned equity interests in family companies by limiting valuation discounts. If so, the regulations would result in the estate of an owner of an equity interest in a family business paying a higher estate tax than the estate of an owner of an identical equity interest in a non-family business.

This paper identifies statutes that focuses on the intent of protecting traditional valuation discounts and narrowing the circumstances in which family companies would be subject to discriminatory transfer tax rules.

Nowhere does the law focus on passive investment companies and active business companies because of the many unanswerable questions it prompts. Such as:

- Is a holding company active or passive if it owns active businesses through subsidiaries?

- Is the parent who crop shares the farm with her farming children active or passive?

- When does rental real estate become active or passive?

- What if the real estate is passively rented to the taxpayer’s active business?

- What about working capital?

Regulation is Contrary to Legislative Intent

Courts will invalidate a regulation manifestly contrary to the intent of a statute, despite the regulation not explicitly contradicting the statute’s language. First, let’s focus on Chapter 14, IRC Section 2704, and the failures of IRC Section 2036. The take-away-points are as follows.

I. IF THE TAXPAYER DEMONSTRATES THAT A NEW REGULATION IS MANIFESTLY CONTRARY TO THE PURPOSE OF IRC SECTION 2704(B), A COURT WILL INVALIDATE THE REGULATION, DESPITE ITS NOT EXPLICITLY CONTRADICTING THE STATUTORY LANGUAGE

-

- The purported regulation does not follow the origin and purpose of the statute

- The Supreme Court enunciated a two-part analysis:

-

-

- Permissible construction, or

- Reasonable interpretation

-

II. IF NEW TREASURY REGULATIONS UNDER IRC SECTION 2704(8)(4) TAKE THE FORM OF THE GREENBOOK PROPOSAL, THE REGULATIONS WILL BE INVALID AS MANIFESTLY CONTRARY TO THE ORIGIN AND PURPOSE OF, AND AS AN UNREASONABLE AND INVALID EXTENSION OF THE AUTHORITY GRANTED IN, IRC SECTION 2704(B)(4)

-

- If the Regulations under IRC Section 2704(b)(4) take the form of the Proposed Regulations, those regulations will violate the origin and purpose of IRC Section 2704(b).

- Prior to the passage of Chapter 14 in 1990, case law for valuing proportionately held family enterprises with one class of equity provided:

- If the Regulations under IRC Section 2704(b)(4) take the form of the Proposed Regulations, those regulations will violate the origin and purpose of IRC Section 2704(b).

-

-

-

- legal rights and interests inherent in that property must first be determined under state law

- transfers of non-controlling interests in family enterprises are to be valued the same way non-controlling interests in non-family enterprises are valued

- no special valuation premiums should result from family attribution in closely held family enterprises

-

-

-

-

- The courts rejected the initial IRS position in 1981 that closely held family businesses should be valued differently than closely held non-family businesses because of family attribution.

- Congress has never supported a change in the case law and made that clear when it passed Chapter 14 (Including IRC Section 2704(b)(4)) in 1990 that Chapter 14 was to be interpreted in a manner consistent with the existing case.

- If new regulations under IRC Section 2704(b) promulgate safe harbors, that would repeat the failures of IRC Section 2036(c), whose repeal was a key to the origin and purpose of Chapter 14.

-

-

-

- Shortly after the passage of Chapter 14 in 1990, when the government’s institutional memory of its origin and purpose was fresh, the Treasury and the IRS consistently recognized that Chapter 14 preserved the pre-existing valuation case law.

- In 1992, the Treasury finalized regulations under IRC Section 2704{b) protecting traditional valuation discounts even for companies that are wholly family owned

- In 1993, the IRS eliminated family attribution in Rev. Rule 93-12, finally acquiescing to the case law

- In 1994, Treasury takes extraordinary steps to excise language in an income tax regulation contradicting Chapter 14 legislative history

- In 1994, the IRS in its own training manual and in its own technical Advice memorandum emphasized that valuation discounts are to be allowed for pro rata interests in family entities and that those discounts are not affected by passage of Chapter 14

- Shortly after the passage of Chapter 14 in 1990, when the government’s institutional memory of its origin and purpose was fresh, the Treasury and the IRS consistently recognized that Chapter 14 preserved the pre-existing valuation case law.

-

-

-

- In 1997, the courts stopped the IRS from reinterpreting Chapter 14 to eliminate valuation discounts and impose family attribution.

-

B. Not only would regulations under IRC Section 2704(b)(4) that take the form of the Regulations violate the origin and purpose of IRC Section 2704(b), those regulations also would be manifestly contrary to its statutory language.

-

- If they take the form of the Regulations, certain regulations will apply to a liquidation restriction already described in other parts of IRC Section 2704(b).

- IRC Section 2704(b) only empowers the IRS to disregard certain restrictions in family entity organizational documents not to replace those disregarded provisions with IRS-invented alternatives.

- Under IRC Section 2704(b)(4), the only restrictions that may be disregarded are those restrictions that have the “Effect of Reducing the Value of the Transferred Interest” below what the transferred interest value would be even if the restriction was not in the organizational documents.

The Results will be the Collection of Less Tax Revenue Not More

In the event that regulations such as those in the Regulations are upheld by the Courts, the regulations are more likely to reduce future income tax revenue more than they increase estate tax revenue.

It is ironic, more accurately strange, that the administration would target valuation discounts now. This IRS project appears to have been on the drawing table for a dozen years, despite the transfer tax landscape being transformed during that period. The increase in the estate tax exemption for a couple has substantially reduced the number of individuals subject to estate tax. However, nearly every taxpayer remains subject to the federal income tax. As a result, an estate planning program is more likely to feature a presentation on planning to reduce income tax than one on planning to reduce estate tax. Moreover, the two types of planning often conflict with each other.

For example, the estate tax value of a partnership interest in a family business also becomes its tax basis for determining capital gains tax if the interest is sold. Moreover, if the post-death tax basis in estate’s partnership interest is higher than its pre-death tax basis, the estate can obtain the benefit of that higher basis in its partnership interest (“outside basis”) by increasing the tax basis in the partnership assets (“inside basis”) attributable to the estate. The estate, therefore, would be able to use the higher estate tax value to reduce income tax without selling the partnership interest in the family business.

The Regulations would eliminate valuation discounts in family partnerships and will increase estate tax in those few estates of unmarried individuals that will remain subject to the estate tax. Eliminating valuation discounts, however, also will increase the tax basis of interests in those same family partnerships and reduce income tax. No one can know whether the estate tax increases will exceed the income tax losses, particularly as the estate tax exemption will increase by more than a hundred thousand dollars every year.

Uncertainty Considerations

The uncertain validity of any proposed regulations modeled on the Regulations will certainly reduce any increase in future gift tax revenue.

The Regulations would have applied “to transfers after the date of enactment”. Any proposed regulations under IRC Section 2504(b)(4), which are sure to be controversial and are “legislative” in nature, should be made effective only upon issuance of final regulations. Even after the regulations become final, as the above discussion demonstrates, their scope and validity will be in doubt. Taxpayers will seek to find ways to cope with the uncertainty.

Government estimates always substantially overestimate the increased gift tax revenue from any law change. This failure relates to the government’s misunderstanding of human nature of taxpayers with estates large enough to potentially be subject to the estate tax. The government presumes that those taxpayers intend to give away certain specific assets, and the taxpayer will proceed with those gifts, despite a substantially increased gift tax cost.

Longtime estate planners can aver that rarely will an individual whose death would generate an estate tax, even the wealthiest, be willing to incur any gift tax to make a transfer of assets during life. First, the individual will seldom predict his or her death and some even doubt its occurrence. Second, the controversy over the estate tax during the last decade, its repeal and reenactment with substantially higher exemptions and lower rate causes individuals to justifiably fear that he or she will be the last gift tax payor. Finally, a wealthy individual is likely convinced that he or she can reinvest the gift tax savings at such a high rate of return that the increased estate will more than offset the higher estate taxes.

As a consequence, taxpayers and their advisors will nearly always hedge against the uncertainty that will arise from any new regulations under IRC Section 2704(b)(4). These hedges will limit any immediate increase in gift tax revenues while on-going litigation increases the frustration of both taxpayers and the government.

Valuation Methods Will Continue to Evolve

In the event that regulations such as those in the Regulations are upheld by the courts, valuation methods will continue to evolve and could result in discounts from net asset value similar to those allowed by present law.

Although new IRC Section 2704(b) regulations might erode the hypothetical buyer/seller test in family businesses, even if ultimately upheld, the regulations will be unable to banish it completely. Moreover, the IRS is unlikely to be able to revive family attribution as contained in Rev. Rul. 81-253. A mixed valuation landscape, therefore, is likely to result. Minority interest and lack of marketability valuation discounts have come to dominate valuations because the courts and the IRS have accepted them. However, valuation is not a static science. Other valuation methods that do not rely on discounts are likely to replace those that do, mitigating the increased tax cost.

For example, one method of valuation, the Non-Marketable Investment Company Evaluation Method,i determines the fair market value of transferred interests in closely held holding companies by estimating the cost of capital that reflects the greater risk associated with the transferred interest in the closely held enterprise in comparison to the investor holding a proportionate share of the assets of the enterprise. This valuation method does not use marketability and minority discounts derived from so-called benchmark studies. This method treats the closely held nature of the transferred interest as a liquidity investment risk that is embodied in the cost of capital for the transferred interest. This valuation method determines what a willing buyer would pay for the transferred interest taking into account liquidity investment risks associated with the expected returns.

How ValueScope Can Help

ValueScope specializes in preparing thoroughly documented tax reporting valuations. Valuation services include:

- Common and preferred stock values (IRC Section 409A)

- Fair market values and discount studies

- Estate and gift valuations

- Reasonable compensation studies

- Employee stock compensation (IRC Section 83(b))

- Transfer pricing analyses (IRC Section 482)

- Worthless stock deductions (IRC Section 165(g)(3))

- Tax inversion transactions (IRC Section 7874)

- Sub Chapter S conversion issues

- Built-in capital gain issues

- Split-Dollar insurance valuations

- Derivatives

- ESOPs

- Steven C. Hastings, CPA/ABV/CFF, CGMA, ASA, CVA

- Principal

- ValueScope, Inc.

- 950 E. State Highway 114 | Suite 120 | Southlake, TX | 76092

- (Office) 817-481-4901 | (Cell) 214-763-7999 | (Fax) 817-481-4905

i Frazier, William H. “Cost of Capital of Family Holding Company Interests.” Cost of Capital, Fifth Edition. Ed. Shannon P. Pratt, Ed. Roger J. Grabowski. Hoboken, New Jersey: John Wiley & Sons, Inc. 2014. 630-649.

Change in Valuation Discount Rules Unlikely