U.S. Oil Companies Impending Debt Crisis

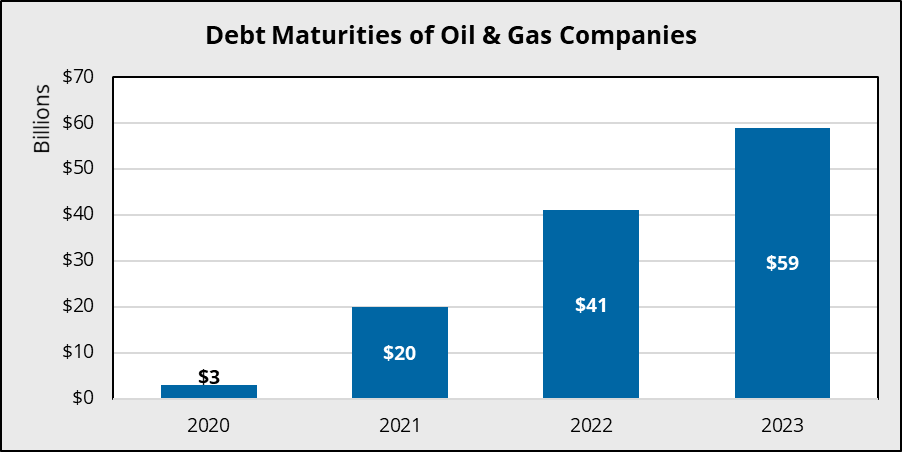

The oil price crash of 2015 and 2016 naturally led to numerous financial difficulties for many oil companies. Following a partial rebounding of prices, oil companies rushed to produce by borrowing significantly. This has led to a “debt wall” with scheduled maturities rising sharply over the next few years.[1]

Many companies will have difficulty paying off these large debt burdens, barring a dramatic increase in oil prices. Bankruptcy filings have increased substantially this year, with 33 filings as of September 30, 2019, relative to 28 all of last year.[2] As the debt burden increases, this number is likely to grow.

Chesapeake Energy Corporation (CHK) announced in early November that there was “substantial doubt” regarding its ability to remain a going concern.[3] Recently CHK received a written notice from the New York Stock Exchange regarding its noncompliance with the requirement to maintain an average closing share price of $1.00 over a consecutive 30 trading-day period.[4]

WTI Crude Oil Outlook

The price distribution below shows the crude oil spot price on December 16, 2019, as well as the predicted crude oil prices based on option and futures markets. The blue lines are within one standard deviation (σ) of the mean, and the red lines are within two standard deviations.

Based on December 16, 2019 prices, the markets indicate that in mid-January 2020 there is a 68% chance that oil prices will be between $55.00 and $64.00 per barrel. Likewise, there is about a 95% chance that prices will be between $48.50 and $70.50. By mid-May 2020, the one standard deviation (1σ) price range is $49.00 to $68.00 per barrel, and the two standard deviation (2σ) range is $38.00 to $83.00 per barrel. In other words, there is a 95% probability that the expected price of oil will be between approximately $38 and $83 per barrel, and a 97.5% probability it will not be above $83 per barrel.

Natural Gas Outlook

We can do the same thing for natural gas, which is currently trading at $2.36 per MMBTU on the Henry Hub. Although more affected by seasonal factors than crude oil, in mid-January 2019, the one standard deviation (1σ) price range is $2.00 to $3.00 per barrel (68% probability) and the two standard deviation (2σ) range is $1.65 to $4.80 per MMBTU (95% probability).

Key Takeaways

Remember, these option analyses deal in expected probabilities, not certain outcomes—but that doesn’t make it any less useful. If someone asks you longingly if oil will be at $100 again soon, you now can respond with “there is about a 97.5% probability that oil prices aren’t expected to get above $83 by mid-May 2020, so I wouldn’t count on it.”

[1] Gladstone, Alexander, “U.S. Oil Patch Stares Down $120 Billion Debt Wall,” The Wall Street Journal, December 3, 2019; https://www.wsj.com/articles/u-s-oil-patch-stares-down-120-billion-debt-wall-11575412192.

[2] Oil Patch Bankruptcy Monitor, Haynes and Boone, LLP, September 30, 2019.

[3] Scurria, Andrew, Alexander Gladstone and Carlo Martuscelli, “Chesapeake Warns On Risk To Business From Sagging Oil Prices,” The Wall Street Journal, November 5, 2019, https://www.wsj.com/articles/chesapeake-warns-on-risk-to-business-from-sagging-oil-prices-11572972005.

[4] Sylvester, Brad, “Chesapeake Energy Corporation Receives Continued Listing Notice From NYSE,” ENP Newswire, December 16, 2019.

For more information, contact:

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.