Oil & Gas Price Outlook October 2016

Oil and Gas are Political Commodities

After last Monday’s debate, when the media declared Hillary Clinton the winner, the overall stock market (S&P 500: SPX) increased by 20 points and oil prices declined by over a dollar per barrel. Oil & Gas Price Outlook October 2016.

As a long-time advocate for fighting climate change, Clinton has proposed generating enough renewable energy to power every home in America, with half a billion solar panels installed by the end of her first term. She also seeks to cut energy waste and to reduce American oil consumption by one third through cleaner fuels and more efficient cars, boilers, ships, and trucks.1

In contrast

Donald Trump supports an increase in fossil fuel production and the lifting of restrictions on E&P Companies to promote economic growth.2 His message addresses the following actions taken by President Obama:

- President Obama’s administration has taken a huge percentage of the Alaska National Petroleum Reserve off the table.

- Oil and natural gas production on federal lands is down 10%.

- 87% of available land in the Outer Continental Shelf has been put off limits.

- Atlantic Lease sales were closed down too – despite the fact that they would create 280,000 jobs and $23.5 billion in economic activity.

- President Obama entered the United States into the Paris Climate Accords – unilaterally, and without the permission of Congress. This agreement gives foreign bureaucrats control over how much energy we use right here in America.3

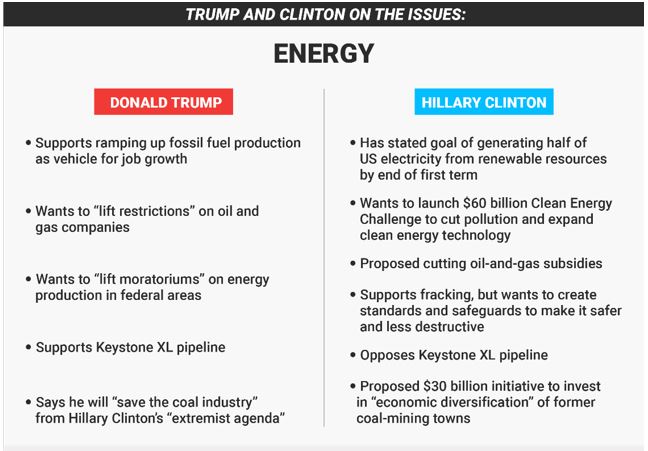

He goes on to say that as bad as President Obama is, Hillary Clinton will be worse. The following table provides a good summary of the candidates’ respective policies.

While certainly an admirable goal, expanding “clean or green energy” is driven by the economics of electric power generation. As long as natural gas is plentiful and inexpensive, given the shale boom, the capital costs associated with solar and wind power can’t be justified without significant tax credits.

On the exploration front

Clinton opposes Arctic drilling and has expressed skepticism for oil production off the southeastern Atlantic coast. Conversely, Trump’s “America First” energy plan will lift most restrictions on oil and gas companies and allow them to drill in both the Arctic and the Gulf of Mexico.

In the option markets, this uncertainty drives the implied volatility of options written on oil and gas futures. Although it changes daily, the current average volatility of around 45% is about two to three times the implied volatility levels in 2015. In approximately 40 days, America and the world will be watching for the results of this key “binary event” and its effect on future energy economics.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future ranges or “confidence intervals” for crude oil and natural gas prices.

The graphic below shows the crude oil price on October 3, 2016 and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the October 3, 2016 prices, the markets indicate that in mid-December 2016, there is about a 68% chance that oil prices will be between $41.50 and $58.00 per barrel. Likewise, there is about a 95% chance that prices will be between $33.00 and $69.00. For a longer-term view, by mid-March 2017, the +/- 1σ price range is $40.00 to $64.00 per barrel, with an expected value of $51.00.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at $2.89 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in December 2016, the +/- 1σ price range is $2.65 to $3.65 per MMBTU and the 2σ range (95%) is $2.15 to $5.55 per MMBTU. The expected value of natural gas prices is $3.27 for the end of 2016.

Tags: Oil & Gas Price Outlook October 2016, Oil Price Outlook Oct 2016, Gas Price Outlook 2016, Natural Gas Price Outlook Oct 2016, Crude Oil Price Outlook 2016

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.