Happy New Year!

Oil & Gas Price Outlook January 2016

After enduring a 32% drop in crude oil prices and a 35% drop in natural gas prices in 2015, this next year has to improve… doesn’t it??

While futures markets aren’t a crystal ball, with a little bit of statistical analysis, they can tell us what market participants expect. All the information needed is available — we can examine where futures and their option prices are today in order to predict where spot prices will be in the future. This process is useful for estimating future price ranges or “confidence intervals” for crude oil and natural gas, in support of better investment and lending decisions.

Crude Oil Outlook

Take a look at the price distribution below, which shows the crude oil spot price on January 4, 2016 and predicted crude oil prices based on options on oil futures contracts. The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see “Probability & Statistics 101” below).

Based on the January 4, 2016 prices, the markets indicate that in mid-February, there is about a 68% chance that oil prices will be between $33.50 and $40.00 per barrel. Likewise, there is about a 95% chance that prices will be between $29.00 and $45.00.

For a longer-term view, I have added a six-month outlook which indicates that in mid-July 2016, the +/- 1σ price range is $31.00 to $58.00 per barrel and the 2σ range is $23.00 to $80.00 per barrel. In other words, there is a 95% probability that the expected price of oil will be between $23.00 and $80.00 per barrel, and a 97.5% probability it will not be above $80.00 per barrel.

Natural Gas Outlook

We can do the same thing for natural gas, which is currently trading at $2.32 per MMBTU on the Henry Hub. Although more affected by seasonal factors than crude oil, in mid-July 2016, the +/- 1σ price range is $1.95 to $3.20 per MMBTU and the 2σ range is $1.52 to $4.10 per MMBTU.

December 2015 in Review

Crude oil futures ended slightly below the predicted one standard deviation confidence interval at $36.83 per barrel. Key factors moving prices over the last 30 days were inventories and rig counts. OPEC failed to agree on a production ceiling for the first time in decades and predicted that oil prices would be (in real terms) around $70 by 2020 and $95 by 2040. Also driving prices downward was the American Petroleum Institute’s announcement that oil inventories rose by 2.9 million barrels, when analysts surveyed by The Wall Street Journal had forecast a drop in oil inventories of 1.0 million barrels.

Key Takeaways

Remember, these analyses reflect the market’s expected probabilities, not certainty—but that doesn’t make it any less useful. If someone asks when oil might trade at $60 again, you now can respond with “there is about an 85% probability that oil will be below $60 in July 2016.” I know this is nothing to get excited about, but at least now you have some idea of the market’s expectations.

Probability & Statistics 101

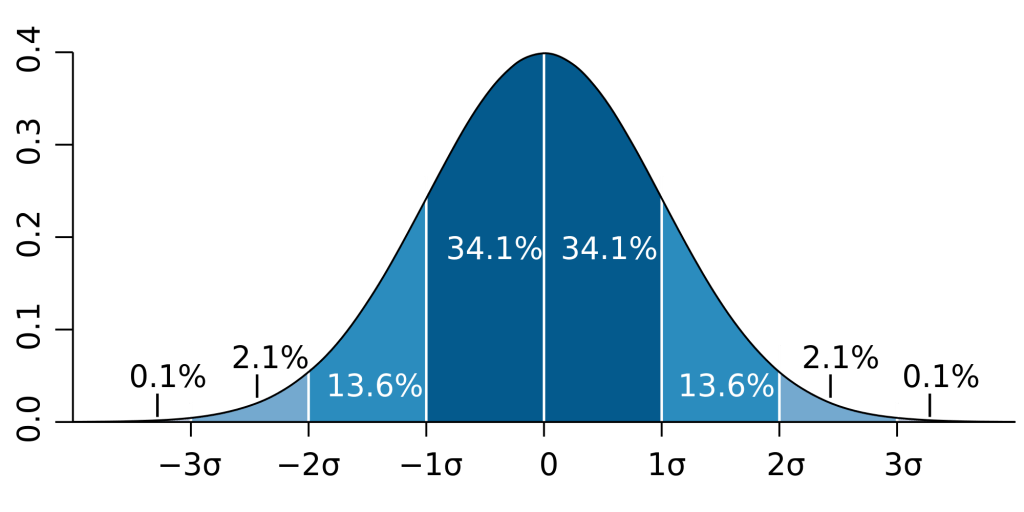

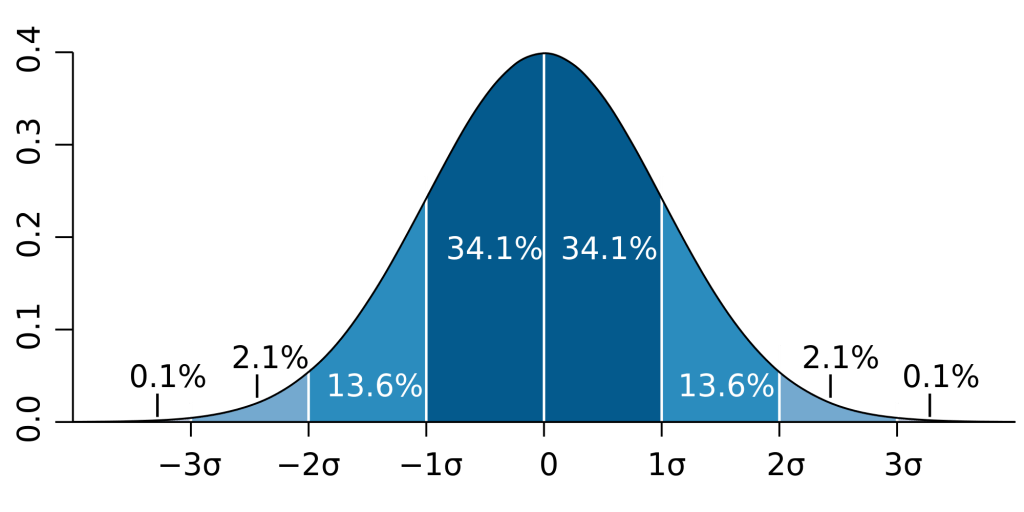

Remember the normal curve from your first statistics class? We can use it to determine the probability that future prices will be within a certain range. In a normal distribution, there’s about a 68% chance that a data point lies within one standard deviation of the mean, and about a 95% chance that it lies within two standard deviations.

Analysts and traders use metrics known as option “Greeks” in order to decode the sensitivities of futures and options to price changes. Using option Greeks, we can determine the prices and probabilities that market participants as a whole are expecting. How can we determine the likely behavior of such a large and often unpredictable group? Because investors are already telling us what they expect by voting with their dollars, not just their intuition.

Tags: Oil & Gas Price Outlook January 2016, Crude Oil Price Outlook, Natural Gas Price Outlook

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

tmcnulty@valuescopeinc.com

Full Bio →

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

bcurrey@valuescopeinc.com

Full Bio →

Apple Eurozone Tax 348 million

If there was any doubt regarding the changing international tax landscape, Apple became among the first of what is sure to be many multi-national enterprises to enter into a multi-million dollar tax settlement related to its European operations. Italy’s La Republicca announced last week that Apple has agreed to pay the Italian tax authority 318 million euro (US $348 million) to settle a tax controversy related to its 2008-2013 tax years. The settlement relates to payments made from Apple’s “high tax” Italian subsidiary to its “low tax” Irish subsidiary. Click here for the original story in La Republicca and here for the English report in Reuters. As part of the settlement, it was reported that Apple will enter into an advance agreement with the Italian tax authorities for future years.

If there was any doubt regarding the changing international tax landscape, Apple became among the first of what is sure to be many multi-national enterprises to enter into a multi-million dollar tax settlement related to its European operations. Italy’s La Republicca announced last week that Apple has agreed to pay the Italian tax authority 318 million euro (US $348 million) to settle a tax controversy related to its 2008-2013 tax years. The settlement relates to payments made from Apple’s “high tax” Italian subsidiary to its “low tax” Irish subsidiary. Click here for the original story in La Republicca and here for the English report in Reuters. As part of the settlement, it was reported that Apple will enter into an advance agreement with the Italian tax authorities for future years.

The Details

While details of the underlying issues were not disclosed, transfer pricing likely played an important role in negotiations. It was reported that Apple recorded more than 1 billion euro in revenue in Italy, but only paid 30 million euro in Italian tax. Payments made from the Italian operating subsidiary to Apple’s Irish headquarters company shifted the majority of the profit from high-taxed Italy to low-taxed Ireland. Apparently Italy was successful in challenging whether those payments were at “arm’s length.”

The Beginning

And this is just the beginning. Countries have barely begun implementing new rules consistent with the October Base Erosion and Profit Shifting (“BEPS”) Project released by the OECD. The rules will increase the transparency of related company profit shifting payments. Once fully implemented, tax authorities in the paying and receiving countries will receive a clear, simply road map to these transactions. This road map will allow them to quickly and easily analyze related company profit shifting payments and determine if a further investigation, audit or assessment is warranted.

Multi-national enterprises must act now to get in front of these fresh challenges.

ValueScope is uniquely positioned to assist companies with everything from an initial risk assessment to the development and documentation of new/adjusted transfer prices.

Spotlight on Transfer Pricing

The US Treasury Department (“Treasury”) and the Internal Revenue Service (“IRS”) released the much-anticipated US Country-by-Country (CbC) Reporting rules on December 21, 2015. These proposed rules, issued in the form of proposed regulation §1.6038-4, would require the ultimate US parent of a multi-national enterprise (MNE) group with annual revenues exceeding $850 million to file an annual report containing the following information on a CbC basis:

- Revenues generated from transactions with members of the MNE group,

- Revenues generated from transactions outside the MNE group,

- Profit (or loss) before income tax,

- Income tax paid (including withholding tax),

- Accrued tax expense,

- Capital,

- Accumulated Earnings,

- Employees (full time equivalents), and

- Assets

The Treasury and the IRS have indicated that the rules are intended to be consistent with the OECD/G20 guidelines finalized this October, although they have requested comments related to taxes paid or accrued in the relevant accounting period and any other item that should be further refined or additional guidance is needed.

The effective date will be for tax years beginning on or after the date of publication of final regulations. That would mean no earlier than 2017 for calendar year taxpayers.

Proposed Rule

The Notice of Proposed Rule Making states that, “The Treasury Department and the IRS have determined that the information required under these proposed regulations will assist in better enforcement of the federal income tax laws by providing the IRS with greater transparency regarding the operations and tax positions taken by US MNE groups.” Specifically, the IRS believes that the CbC reports will assist them in performing high-level transfer pricing risk identification and assessment.

The Notice

The Notice states that the proposed regulations were issued pursuant to the Treasury’s existing authority granted under sections 6001, 6011, 6012, 6031, 6038, and 7805. Previously, the Treasury had implied that the issuance of these rules should help protect the confidentiality of the information provided by US MNE groups. For example, if the US were to delay implementation of the CbC reporting rules, foreign subsidiaries of the US MNE group might still be required to provide CbC reports to local taxing jurisdictions. These CbC reports could be provided to taxing jurisdictions that do not have a treaty with the US that will provide for built-in protection of the confidentiality of taxpayer information.

Even though these rules are not yet effective, US MNE groups need to review immediately their own transfer pricing risk from both a US and a foreign tax perspective and make whatever structural changes are necessary to minimize those risks.

The Chart

The chart below provides an example of how the IRS would use this report to highlight transfer pricing risk. US Co owns 100% of three foreign subsidiaries. The graph below reflects the profit level by number of employees as well as the effective tax rate of the entity. The size of the circle indicates the number of employees. Based on the data provided in the CbC report, the IRS would likely suspect that the transfer pricing methods utilized by US Co inappropriately shift profits to a low-taxed foreign subsidiary and would begin a formal review.

ValueScope is available to assist with everything required in this process, from the initial risk assessment to the development and documentation of new/adjusted transfer prices.

Our research suggests it will, but not for a few more years.

Disney’s ROI Return on Investment Star Wars

When Star Wars: The Force Awakens arrives in theaters, the question isn’t whether it will shatter records—it’s by how much. Many sources estimate The Force Awakens will be the highest-grossing film of 2015 both domestically and internationally, with figures in excess of $1.5 billion. An analysis by Morgan Stanley in November estimates it will be among the top three highest-grossing films of all time. While these are impressive numbers, what do they mean for Disney’s return on a $4 billion investment in Lucasfilm Ltd? Disney’s ROI Return on Investment Star Wars.

Merchandising

Merchandising has the potential to be even more lucrative than the film itself. When Disney bought Lucasfilm Ltd in 2012, they certainly had an eye toward integrating Star Wars into their already dominant brand merchandising, and that’s exactly what they’ve done. Star Wars-themed attractions are slated for construction in both Disneyland and Disney World. There are stormtrooper necklaces from Kay, a Millennium Falcon bed from Pottery Barn, and even intergalactic Coffee-mate creamers and a Luke Frywalker Mr. Potato Head. In 2014, global retail sales of Star Wars merchandise were $2.4 billion, making it the fifth-most popular licensed brand in the world—but another Morgan Stanley analysis estimates that The Force Awakens could double that figure to $4.9 billion, making it the number one best-selling brand worldwide.

Considerations

Considering these enormous numbers and the fact that The Force Awakens is just the first of five or six Star Wars films slated to release by the end of 2020, it’s obvious that Disney’s purchase of Lucasfilm was a smart investment—but it may take longer than expected for Disney to break even on the purchase. For one, Disney doesn’t necessarily get royalties from the sale of every single Star Wars toy—more than likely, most of the toy companies pay a one-time licensing fee to Disney for rights to the brand and then keep the revenue for themselves.

Moreover, because of Hollywood’s opaque accounting practices, it’s unclear how much of a cut Disney will receive from the first few weeks of ticket sales. We estimate that, when all is said and done, Disney will retain anywhere from 40% to 60% of the film’s gross ticket sales—but even if The Force Awakens exceeds every expectation and pulls in $1.5 or $2 billion, that won’t be enough to break even on their buyout of Lucasfilm.

The Crowd

However, the great thing about a franchise like Star Wars is its ability to reliably draw a crowd again and again. Disney has a Star Wars film slated to be released every year between now and 2019. Even if next year’s Rogue One spin-off doesn’t quite pull Disney’s revenues over the $4 billion mark, Episode VIII almost certainly will. It may end up taking five years, but by the eighth installment’s release in 2017, Bob Iger and the rest of Disney can confidently say they made a good investment.

Tags: Disney’s ROI Return on Investment Star Wars

SENIOR MANAGER

bshockley@valuescopeinc.com

Several quarters remain before bankruptcy attorneys return to high employment. However, weakness in specific sectors should provide an increased flow of near term bankruptcy activity.

Summary of 2015 Shared National Credit Review[1],[2]

In 2013, bank regulatory agencies (the “Regulators”) released the Interagency Guidance on Leveraged Lending (the “Guidance”) intended to curtail perceived excesses in bank lending practices. One of the most impactful elements of the Guidance was the rule that banks should not make “non-pass” loans. The Guidance defined “pass” loans as loans in which the borrower demonstrated the ability to repay all of its senior debt and one-half of its total debt in a five to seven year period.

The Guidance initially proved confusing and banks did not immediately adopt its recommendations to the Regulators’ satisfaction. After the Regulators criticized banks for non-compliance in the 2014 Shared National Credit Review (the 2014 “SNC Review”), banks appear to have gotten the message. After the 2015 SNC Review, Comptroller of the Currency Thomas Curry stated, “[T]he 2015 SNC Review found lower levels of leverage and improved repayment capacity in bank leveraged loan portfolios.”

Statistics compiled by the Loan Syndications and Trading Association shown in the charts below support the findings of the 2015 SNC Review.

Footnotes

[1] Coffey, Meredith, “SNC: Banks Complying With LLG Rules… But SNC Suggests Rules Might Change”, November 2015; Loan Syndication and Trading Website at http://www.lsta.org/news-and-resources/news/1/snc-banks-complying-with-llg-rules-but-snc-suggests-rules-might-change

[2] Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, Shared National Credits Program 2015 Review, November, 2015 at http://www.occ.treas.gov/news-issuances/news-releases/2015/nr-ia-2015-149a.pdf

Christopher C. Lucas, CFA, CPA

PRINCIPAL

clucas@valuescopeinc.com

Full Bio →

Oil & Gas Price Outlook December 2015

Don’t rely upon Wall Street soothsayers — if you want to predict the future of oil & gas prices, rely on probabilities and not a crystal ball. For instance, Goldman Sachs recently made headlines when an analyst noted that $20 oil was possible next year. Analysts can run large macroeconomic models to predict such values, but they are all predicated on numerous assumptions. Is there a better source of insight for future oil & gas prices?

While futures markets today can’t determine the future for sure, with a little bit of straightforward statistical analysis, they can tell us what market participants expect. All the information needed is available—we can examine where futures prices are today in order to predict where spot prices will be in a few weeks or months. This process is useful for estimating the future price range of any traded commodity, but it’s very helpful as a barometer for the energy market as a whole.

Crude Oil Outlook

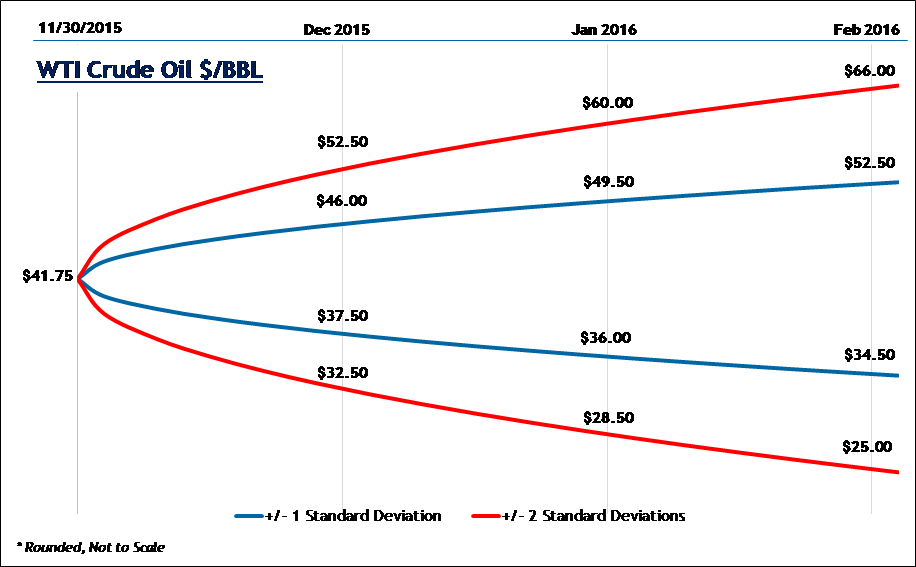

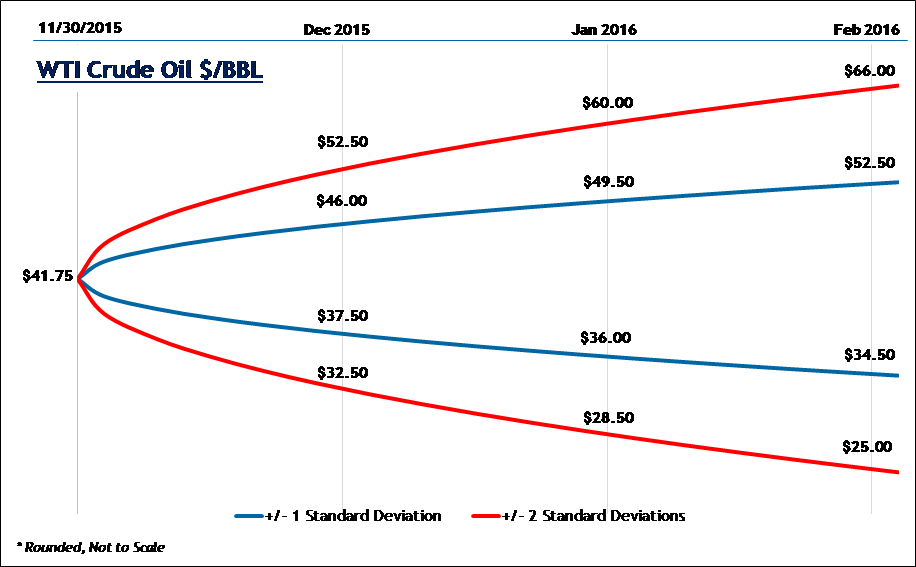

Take a look at the price distribution below, which shows the crude oil spot price on November 30, 2015 and predicted crude oil prices based on option and futures markets. The blue lines are within one standard deviation (σ) of the mean and the red lines are within two standard deviations (for a refresher on standard deviations, see “Probability & Statistics 101” below).

Based on the November 30, 2015 prices, the markets indicate that at year-end there is about a 68% chance that oil prices will be between $37.50 and $46.00 per barrel. Likewise, there is about a 95% chance that prices will be between $32.50 and $52.50. At the end of February 2016, the +/- 1σ price range is $34.50 to $52.50 per barrel and the 2σ range is $25.00 to $66.00 per barrel. In other words, there is a 95% probability that the expected price of oil will be between $25 and $66 per barrel, and a 97.5% probability it will not be above $66 per barrel.

Natural Gas Outlook

We can do the same thing for natural gas, which is currently trading at $2.25 per MMBTU on the Henry Hub. Although more affected by seasonal factors than crude oil, at the end of February 2016, the +/- 1σ price range is $1.95–$2.80 per barrel (68% probability) and the +/- 2σ range is $1.30 to $3.70 per MMBTU (95% probability).

Key Takeaways

Remember, these analyses deal in expected probabilities, not certainty—but that doesn’t make it any less useful. If someone asks you longingly if oil will be at $75 again soon, you now can respond with “there is about a 97.5% probability that oil prices aren’t expected to get above $66 before the end of February 2016, so I wouldn’t count on it.” Likewise, if you’re a banker whose borrower needs at least $3.50 natural gas prices in order to meet their debt service obligations in early 2016, the fact that there’s about a 95% chance that gas prices will be lower than this number should help you make a more informed decision— no black magic required.

Probability & Statistics 101

Remember the normal curve from your first statistics class? We can use it to determine the probability that future prices will be within a certain range. In a normal distribution, there’s about a 68% chance that a data point lies within one standard deviation of the mean, and about a 95% chance that it lies within two standard deviations.

Analysts and traders use metrics known as option Greeks in order to decode the sensitivities of futures and options to price changes. Using option Greeks, we can determine the prices and probabilities that market participants as a whole are expecting. How can we determine the likely behavior of such a large and often unpredictable group? Because investors are already telling us what they expect by voting with their dollars, not just their intuition.

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

tmcnulty@valuescopeinc.com

Full Bio →

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

bcurrey@valuescopeinc.com

Full Bio →

If you liked this blog you may enjoy reading some of our other blogs here.

CbC Not For Me? Think Again. OECD Aligning Transfer Pricing

CbC Not For Me? Think Again. OECD Aligning Transfer Pricing

To the extent that the US multi-national has entered into a CSA with an entity with a tax home in a country that has adopted the OECD Transfer Pricing guidelines, a conflict will arise with respect to the allocation of development costs. The OECD country tax authority will potentially look to value the contributions of each participant at some amount greater than cost.

To the extent that the US multi-national has entered into a CSA with an entity with a tax home in a country that has adopted the OECD Transfer Pricing guidelines, a conflict will arise with respect to the allocation of development costs. The OECD country tax authority will potentially look to value the contributions of each participant at some amount greater than cost.

If there was any doubt regarding the changing international tax landscape, Apple became among the first of what is sure to be many multi-national enterprises to enter into a multi-million dollar tax settlement related to its European operations. Italy’s La Republicca announced last week that Apple has agreed to pay the Italian tax authority 318 million euro (US $348 million) to settle a tax controversy related to its 2008-2013 tax years. The settlement relates to payments made from Apple’s “high tax” Italian subsidiary to its “low tax” Irish subsidiary. Click

If there was any doubt regarding the changing international tax landscape, Apple became among the first of what is sure to be many multi-national enterprises to enter into a multi-million dollar tax settlement related to its European operations. Italy’s La Republicca announced last week that Apple has agreed to pay the Italian tax authority 318 million euro (US $348 million) to settle a tax controversy related to its 2008-2013 tax years. The settlement relates to payments made from Apple’s “high tax” Italian subsidiary to its “low tax” Irish subsidiary. Click