Oil & Gas Price Outlook January 2017

2016 Price Review and Looking Forward to 2017

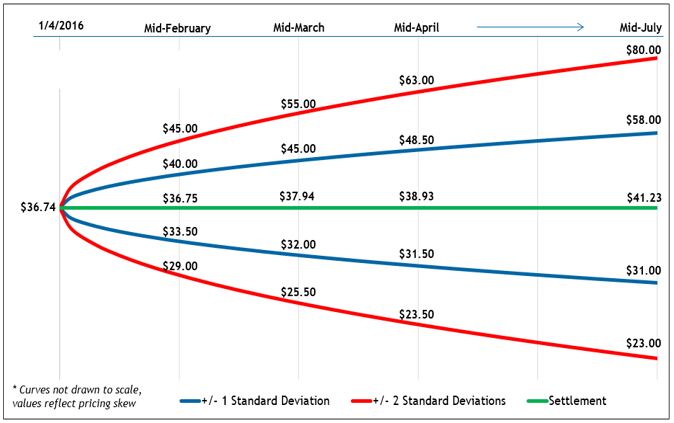

As is popular this time of year, we wanted to do a quick review of the range of prices suggested by the strip price and the options markets as of the beginning of last year (2016). – Oil & Gas Price Outlook January 2017.

At the time (January 2016), the forecast oil strip price for year-end 2017 was approximately $43 per barrel and the one standard deviation range around that price was about $30 – $60 per barrel. As of today, the price of oil is about $53 per barrel.

The price forecast chart from one year ago:

Put differently, although one could argue that the forecast strip price was approximately 20% too low, the price today is solidly within the one standard deviation range, or within the 68% probability-weighted range. Making investment decisions based on this range and understanding the effects of both suggested price outcomes would have served an investor well last year.

In a recent equity research report, Credit Suisse sees 2017 as entering a Renaissance,1 claiming that after three years, the downturn looks closer to its end. The report notes that OPEC is cutting production to bring the rebalance of oil markets forward, the global economy has shrugged off its late 2015 weakness, and risk appetite is back in normal territory. As shale players get back to work, investors will need to watch how much production can come back for a given level of oil price. Broadly, Credit Suisse’s analysts remain comfortable with a “new normal” for oil prices at the $60’s per BBL level. Below, we consider what market participants believe future commodity prices will be, given future strip prices and option clearing prices.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels, and related options are useful for estimating future ranges or “confidence intervals” for crude oil and natural gas prices.

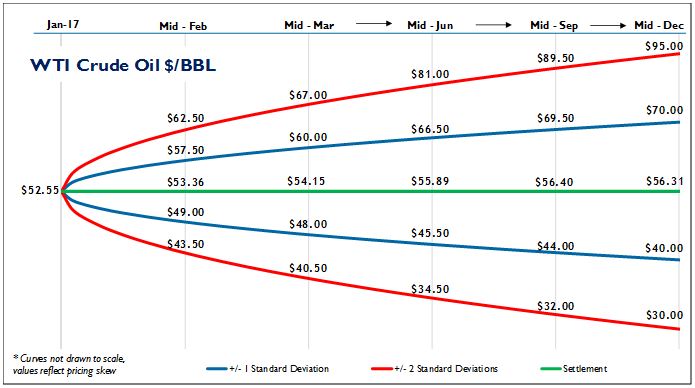

The graphic below shows the crude oil price on January 17, 2017, and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the January 17, 2017 prices, the markets indicate that in mid-March 2017, there is about a 68% chance that oil prices will be between $48 and $60 per barrel. Likewise, there is about a 95% chance that prices will be between $40.50 and $67. For a longer-term view, by mid-December 2017, the +/- 1σ price range is $40 to $70 per barrel, with an expected value of $56.31.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at $3.40 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in March 2017, the +/- 1σ price range is $2.85 to $4.15 per MMBTU and the 2σ range (95%) is $2.35 to $5.15 per MMBTU. The expected value of natural gas prices in mid-March 2017 is $3.40 per MMBTU.

1 – Credit Suisse, December 19, 2016 – Global Equity Research, Energy in 2017

Tags: Oil & Gas Price Outlook January 2017, Oil Price Outlook Jan 2017, Natural Gas Outlook Jan 2017

For more information, contact:

Andrew Avalos

SENIOR ASSOCIATE – ENERGY PRACTICE

If you liked this blog you may enjoy reading some of our other blogs here.

ValueScope’s Oil & Gas Price Outlook: December 2016

Oil & Gas Price Outlook December 2016

Happy Days are Here Again?

As reported by Bloomberg, OPEC clinched a deal to curtail oil supply, its first cuts in eight years. OPEC will reduce production by 1.2 million barrels a day to 32.5 million a day in an effort to push inventories down (according to two delegates asking not to be identified as the decision wasn’t yet public). Oil & Gas Price Outlook December 2016.

The breakthrough deal showed an apparent acceptance by Saudi Arabia that Iran, as a special case, can raise its production.

Prior to 2014, the Organization of Petroleum Exporting Countries served the role as a “price fixer.” In 2014, the group adopted a pump-at-will policy which contributed to the approximate 80% fall in oil prices.

This decision immediately impacted crude oil spot and futures prices, with Brent Crude prices rising above $50 per barrel (still half of its high price in 2014). Additionally, Russia, the biggest producer outside the bloc, has said if OPEC agrees on individual country quotas it’s ready to participate, including possibly reducing. According to Bloomberg, OPEC is likely to hold talks with non-OPEC producers next week.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels, and related options are useful for estimating future ranges or “confidence intervals” for crude oil and natural gas prices.

The graphic below shows the crude oil price on December 1, 2016, and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the December 1, 2016 prices, the markets indicate that in mid-January 2017, there is about a 68% chance that oil prices will be between $45.00 and $59.00 per barrel. Likewise, there is about a 95% chance that prices will be between $37.50 and $68.00. For a longer-term view, by mid-March 2017, the +/- 1σ price range is $44.00 to $63.00 per barrel, with an expected value of $53.50.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at $3.51 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in January 2017, the +/- 1σ price range is $2.95 to $4.45 per MMBTU and the 2σ range (95%) is $2.35 to $6.05 per MMBTU. The expected value of natural gas prices in mid-January 2017 is $3.51 per MMBTU.

Tags: Oil & Gas Price Outlook December 2016, Gas Price Outlook Dec 2016, Oil Price Outlook Dec 2016, Crude Oil Price Outlook Dec 2016

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.

ValueScope’s Oil & Gas Price Outlook: November 2016

Oil & Gas Price Outlook November 2016

Industry Survey Results Compared to Futures Pricing

The investment bank Credit Suisse recently surveyed a group of 128 investors on their outlook for oil prices in February 2018. According to the report, the survey group was comprised primarily of “Long Only” investors, hedge funds and energy companies. A summary graph of their responses is presented below. Oil & Gas Price Outlook November 2016

These results indicate that the average expected value is +/- $45/BBL for February of 2018.

Also, this price distribution from the survey closely approximates that shown in the NYMEX oil futures (/CL), and their option-driven probabilities that we discuss further below.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future ranges or “confidence intervals” for crude oil and natural gas prices.

The graphic below shows the crude oil price on November 4, 2016 and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the November 4, 2016 prices, the markets indicate that in mid-December 2016, there is about a 68% chance that oil prices will be between $38.50 and $51.00 per barrel. Likewise, there is about a 95% chance that prices will be between $32.00 and $58.50. For a longer-term view, by mid-April 2017, the +/- 1σ price range is $36.50 to $60.50 per barrel, with an expected value of $47.07.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at $2.78 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in December 2016, the +/- 1σ price range is $2.45 to $3.65 per MMBTU and the 2σ range (95%) is $1.95 to $4.85 per MMBTU. The expected value of natural gas prices is $2.95 for the end of 2016.

Tags: Oil & Gas Price Outlook November 2016, Oil Price Outlook Nov 2016, Gas Price Outlook Nov 2016, Natural Gas Outlook Nov 2016, Crude Oil Outlook Nov 2016

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.

ValueScope’s Oil & Gas Price Outlook: October 2016

Oil & Gas Price Outlook October 2016

Oil and Gas are Political Commodities

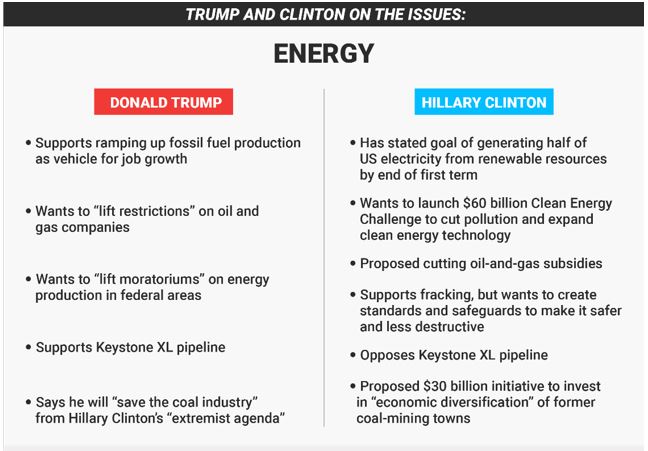

After last Monday’s debate, when the media declared Hillary Clinton the winner, the overall stock market (S&P 500: SPX) increased by 20 points and oil prices declined by over a dollar per barrel. Oil & Gas Price Outlook October 2016.

As a long-time advocate for fighting climate change, Clinton has proposed generating enough renewable energy to power every home in America, with half a billion solar panels installed by the end of her first term. She also seeks to cut energy waste and to reduce American oil consumption by one third through cleaner fuels and more efficient cars, boilers, ships, and trucks.1

In contrast

Donald Trump supports an increase in fossil fuel production and the lifting of restrictions on E&P Companies to promote economic growth.2 His message addresses the following actions taken by President Obama:

- President Obama’s administration has taken a huge percentage of the Alaska National Petroleum Reserve off the table.

- Oil and natural gas production on federal lands is down 10%.

- 87% of available land in the Outer Continental Shelf has been put off limits.

- Atlantic Lease sales were closed down too – despite the fact that they would create 280,000 jobs and $23.5 billion in economic activity.

- President Obama entered the United States into the Paris Climate Accords – unilaterally, and without the permission of Congress. This agreement gives foreign bureaucrats control over how much energy we use right here in America.3

He goes on to say that as bad as President Obama is, Hillary Clinton will be worse. The following table provides a good summary of the candidates’ respective policies.

While certainly an admirable goal, expanding “clean or green energy” is driven by the economics of electric power generation. As long as natural gas is plentiful and inexpensive, given the shale boom, the capital costs associated with solar and wind power can’t be justified without significant tax credits.

On the exploration front

Clinton opposes Arctic drilling and has expressed skepticism for oil production off the southeastern Atlantic coast. Conversely, Trump’s “America First” energy plan will lift most restrictions on oil and gas companies and allow them to drill in both the Arctic and the Gulf of Mexico.

In the option markets, this uncertainty drives the implied volatility of options written on oil and gas futures. Although it changes daily, the current average volatility of around 45% is about two to three times the implied volatility levels in 2015. In approximately 40 days, America and the world will be watching for the results of this key “binary event” and its effect on future energy economics.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future ranges or “confidence intervals” for crude oil and natural gas prices.

The graphic below shows the crude oil price on October 3, 2016 and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the October 3, 2016 prices, the markets indicate that in mid-December 2016, there is about a 68% chance that oil prices will be between $41.50 and $58.00 per barrel. Likewise, there is about a 95% chance that prices will be between $33.00 and $69.00. For a longer-term view, by mid-March 2017, the +/- 1σ price range is $40.00 to $64.00 per barrel, with an expected value of $51.00.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at $2.89 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in December 2016, the +/- 1σ price range is $2.65 to $3.65 per MMBTU and the 2σ range (95%) is $2.15 to $5.55 per MMBTU. The expected value of natural gas prices is $3.27 for the end of 2016.

Tags: Oil & Gas Price Outlook October 2016, Oil Price Outlook Oct 2016, Gas Price Outlook 2016, Natural Gas Price Outlook Oct 2016, Crude Oil Price Outlook 2016

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.

ValueScope’s Oil & Gas Price Outlook: September 2016

Oil & Gas Price Outlook September 2016

End of August Supply Concerns

WTI oil prices fell over 3.5% on Wednesday, paring their 20%+ gains in August, based on new supply information from Saudi Arabia and the EIA. Oil prices’ recent gains had been driven by speculation that OPEC and other producers would agree to curb their output, causing prices to reach a high of over $49 per barrel. Oil & Gas Price Outlook September 2016

However, on August 31st, the Saudi Arabian energy minister Khalid al-Falih said that the top crude exporter does not have a specific target figure for its oil production and that its output depends on the needs of its customers.

Also, on the same day the EIA announced that crude stockpiles rose for a second straight week, building by 2.3 million barrels last week, compared with analysts’ expectations for a rise of only 0.9 million barrels. At 525.9 million barrels, U.S. crude oil inventories are at historically high levels for this time of year.1

August Daily Crude Futures Pricing (\CL)

These two announcements contributed to both spot and future’s prices for oil decreasing over $1.50 per barrel on the last day of the month. As of this blog’s posting, oil prices were down another dollar on the first.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future ranges or “confidence intervals” for crude oil and natural gas prices.

The graphic below shows the crude oil price on September 1, 2016 and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the September 1, 2016 prices, the markets indicate that in mid-December, there is about a 68% chance that oil prices will be between $38.00 and $53.50 per barrel. Likewise, there is about a 95% chance that prices will be between $29.00 and $64.00. For a longer-term view, by mid-March 2017, the +/- 1σ price range is $36.50 to $60.50 per barrel.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at about $2.87 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in December 2016, the +/- 1σ price range is $2.65 to $3.85 per MMBTU and the 2σ range is $2.15 to $5.05 per MMBTU. The expected midpoint of natural gas prices is $3.17 for the end of 2016.

- US EIA Weekly Report, CNBC 8/30/16

Tags: Oil & Gas Price Outlook September 2016

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.

To receive updates on our news and blogs.

We will never share your data!

Download a PDF version of this blog by clicking here.

ValueScope’s Oil & Gas Price Outlook: August 2016

Oil & Gas Price Outlook August 2016

Gasoline Prices Not Costing an “Arm and a Leg” This Summer

According to CNBC1, gasoline prices — at $2.16 per gallon nationally — could fall another 10 percent or more, and while that’s good for consumers, it may not be so for stock market investors.

According to CNBC1, gasoline prices — at $2.16 per gallon nationally — could fall another 10 percent or more, and while that’s good for consumers, it may not be so for stock market investors.

That’s because there’s now a glut of gasoline, and that is pressuring oil prices. The oversupply of crude in world markets turned into a product glut this summer, with refiners producing more gasoline and diesel than is needed, even with near-record high demand. According to AAA, the national average for unleaded gasoline is down 15 cents in a month.

![]()

Gasoline futures trade under the symbol RBOB, or Reformulated Gasoline Blendstock for Oxygen Blending (simply the term given to unleaded gas futures). As one would expect, gasoline prices follow oil price movements.

Also, RBOB prices will always be lower than gasoline prices at the pump, since they are measured at a specific delivery point (for the contracts) and their prices do not include transportation fees, storage costs and retail profits.

“These are the cheapest gasoline prices for the end of July since 2004. There’s 36 states where you see gas less than $2 a gallon. The really cheap prices will be between Labor Day and Election Day,” said Tom Kloza, global head of energy analysis at Oil Price Information Services. Kloza expects the national average to fall below $2 per gallon, and said another 10 percent decline could easily be in store.2

Looking at the futures market for RBOB3, it is obvious there is a strong seasonal factor to pricing with the lows being around January of each year, so Kloza’s comments above could pan out as the 2016 Election approaches.

As with all statistical analyses, however, the devil is in the details and it is often difficult to discern between “correlation and causality.”

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future price ranges or “confidence intervals” for crude oil and natural gas. Crude oil prices have dropped by nearly 20% from one month ago, representing a decrease of approximately one standard deviation downward.

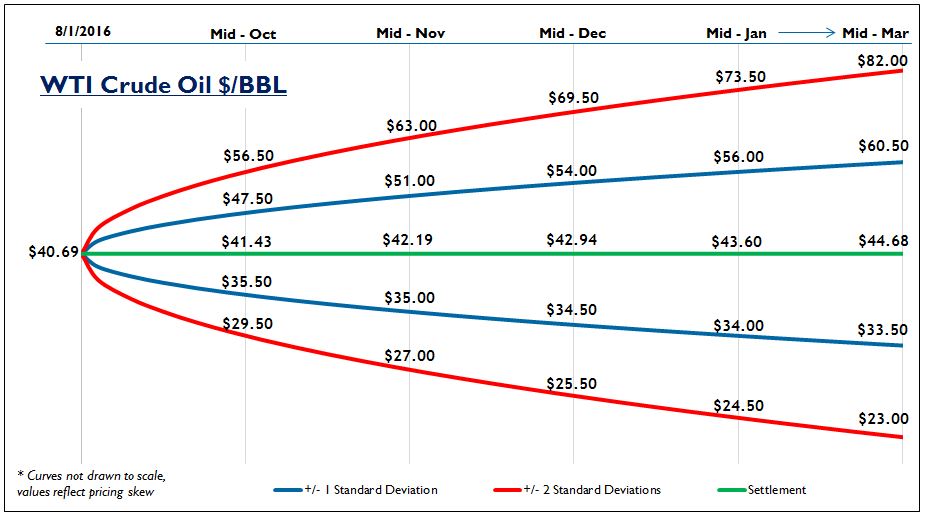

The graphic below shows the crude oil price on August 1, 2016 and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the August 1, 2016 prices, the markets indicate that in mid-October, there is about a 68% chance that oil prices will be between $35.50 and $47.50 per barrel. Likewise, there is about a 95% chance that prices will be between $29.50 and $56.50. For a longer-term view, by mid-December 2016, the +/- 1σ price range is $34.50 to $54.00 per barrel. This upward skew in the price ranges also drives the expected midpoint of $42.94 per barrel at year end.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at about $2.82 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in mid-December 2016, the +/- 1σ price range is $2.65 to $4.15 per MMBTU and the 2σ range is $2.05 to $5.45 per MMBTU. The expected midpoint of natural gas prices is $3.28 for the end of 2016.

-

CNBC.com, July 25, 2016, Patti Domm

-

Ibid.

-

http://www.barchart.com/commodityfutures/Gasoline_Rbob_Futures/RB?search=RB*+

Tags: Oil & Gas Price Outlook August 2016, Oil Price Outlook, Gas Price Outlook, Crude Oil Outlook, Natural Gas Price Outlook, Oil Price Prediction

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.

To receive updates on our news and blogs.

We will never share your data!

ValueScope’s Oil & Gas Price Outlook: July 2016

Oil & Gas Price Outlook July 2016

“Buying Time” Is Expensive for Oilfield Service Companies

ValueScope recently analyzed and provided a fairness opinion for a private equity (“PE”) firm’s subsequent investment in an oilfield service company. Based on our analyses, the service company would violate the EBITDA covenants on its debt in 2017 and would need cash to buy back a portion of its debt. Due to recent market conditions, the company did not have adequate working capital for this and was unable to take on any more bank debt.

Therefore, seeking an additional equity investment was required, versus risking bankruptcy next year. Previously, the existing shareholders had invested at $1.00 per share. A PE firm agreed to invest $100M dollars under the following terms:

- The security would be a preferred security, senior to all other equity classes

- This additional investment would provide allow them to get through the 2017 debt paybacks required

- Capital was also earmarked for a $50M acquisition of assets (at a fraction of their original cost) from another bankrupt service company

In addition to being senior to all other classes of shareholders, the “new money” negotiated for its shares to be valued at 60 cents per share. This price reduced value of existing shareholders in an exit scenario, and gave new money approximately 70% more shares than a value of $1.00, thus creating even more dilution for the existing shareholders.

The good news is that new equity capital is being invested in this market, but it requires tough choices for existing shareholders:

- take a significant valuation haircut now, in exchange for financial flexibility and duration, or

- roll the dice (effectively betting the entire value of their equity) on acquiring a future source of capital under better terms.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future price ranges or “confidence intervals” for crude oil and natural gas.

The graphic below shows the crude oil price on June 30, 2016 and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the June 30, 2016 prices, the markets indicate that in mid-August, there is about a 68% chance that oil prices will be between $37.50 and $62.50 per barrel. Likewise, there is about a 95% chance that prices will be between $32.50 and $75.00. For a longer-term view, by mid-December 2016, the +/- 1σ price range is $38.00 to $79.00 per barrel. This upward skew in the price ranges also drives the expected midpoint of $53.64 per barrel at year end.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at about $2.89 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in mid-December 2016, the +/- 1σ price range is $2.65 to $4.25 per MMBTU and the 2σ range is $2.05 to $5.75 per MMBTU. The expected midpoint of natural gas prices is $3.29 for the end of 2016.

Tags: Oil & Gas Price Outlook July 2016, Oil Price Outlook July 2016, Gas Price Outlook July 2016, Natural Gas Price Outlook, Crude Oil Price Outlook

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.

To receive updates on our news and blogs.

We will never share your data!

ValueScope’s Oil & Gas Price Outlook: June 1, 2016

Oil & Gas Price Outlook June 2016

“Market Gurus” – Worth Following?

Many financial players (investors, bankers, fund managers, etc.) are quoted daily with their view on the markets, predictions for oil and gas prices, etc. For instance, in September 2015, a forecast by Goldman Sachs suggested that oil could tank to $20 per barrel.[1] Fast forward a few months, and in January 2016 Goldman said it was sticking with its $40 per barrel forecast (2X their previous forecast) for the first half of 2016. The investment bank went on to say that it sees a new bull market in oil starting to evolve in late 2016 as market adjustments balance out supply and demand.[2] Curious that Goldman was sticking with a $40 per barrel forecast shortly after  predicting that oil prices would go to $20 per barrel? Oil & Gas Price Outlook June 2016.

predicting that oil prices would go to $20 per barrel? Oil & Gas Price Outlook June 2016.

Another example is that T. Boone Pickens predicted on CNBC’s “Squawk Box” on February 1, 2016 that oil prices will advance to at least $52 per barrel by the end of 2016, saying that U.S crude oil had touched the bottom at $26 per barrel. Nonetheless, just a few days after his interview on “Squawk Box”, the founder of energy-focused BP Capital claimed in a separate interview on “Bloomberg Go” that he had sold out of all of his oil-related holdings and awaits better entry points.[3]

Our point of view is that markets are reasonably efficient and that when market participants invest, they put “their money where their mouth is.” With market gurus making predictions daily, many seem to be doing just the opposite of their advice.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future price ranges or “confidence intervals” for crude oil and natural gas.

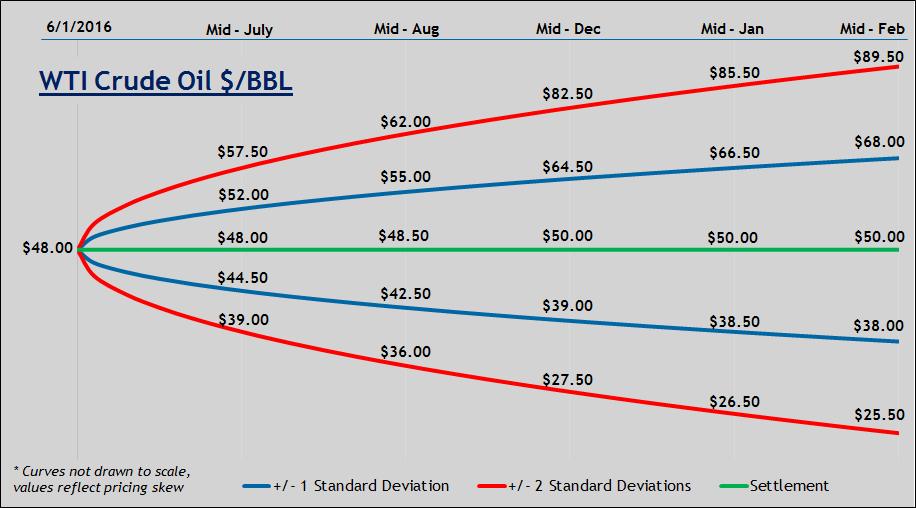

The graphic below shows the crude oil price on June 1, 2016 and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the June 1, 2016 prices, the markets indicate that in mid-August, there is about a 68% chance that oil prices will be between $42.50 and $55.00 per barrel. Likewise, there is about a 95% chance that prices will be between $36.00 and $62.00. For a longer-term view, by mid-December 2016, the +/- 1σ price range is $39.00 to $64.50 per barrel. This upward skew in the price ranges also drives the expected midpoint of $50.00 per barrel at year end.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at about $2.30 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in mid-November 2016, the +/- 1σ price range is $2.15 to $3.45 per MMBTU and the 2σ range is $1.55 to $4.65 per MMBTU. The expected midpoint of natural gas prices is $3.00 for the end of 2016.

Tags: Oil & Gas Price Outlook June 2016, Oil Price Outlook, Gas Price Outlook, Crude Oil Price Outlook, Natural Gas Price Outlook

[1] CNBC September 11, 2015 Interview

[2] OilPrice.com, January 20, 2016

[3] Commodities, Hedge Fund Analysis, February 18, 2016

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.

To receive updates on our news and blogs.

We will never share your data!

ValueScope’s Oil & Gas Price Outlook: May 2, 2016

Oil & Gas Price Outlook May 2016

Market Capitalization’s Impact on MLP Yields and Multiples

Investors and valuation experts have long debated the general magnitude (and even the existence) of a “small stock risk premium” and its effect on market values. Small stock risk implies simply that investors expect a higher rate of return for investments in smaller companies (given a higher perceived level of risk).

A recent research report on Master Limited Partnership (“MLP”) values illustrates this concept and how it plays out in two groups of MLP’s with different size market capitalizations. The “Large Cap MLP Group” reflects companies with market capitalization of more than $3.5 billion. For this group, shown below, their current yield has a median value of 15.1% and the enterprise values are trading at a median of 13.5 times their estimated 2016 EBITDA.

The “Small and Mid-Cap MLP Group” reflects companies with market capitalization less than $3.5 billion. For this group, shown below, their current yield has a median value of 7.3% and the enterprise values are trading at a median of 9.6 times their estimated 2016 EBITDA.

As shown above, the market has priced these securities so that the median yield for the Small and Mid-Cap Group is almost 8% higher that of the larger group. All else equal, an 8% higher distribution rate would imply a higher cost of equity required by the market, which results in lower values. This concept is further supported by the 2016 EBITDA multiple effect shown in the data above. The EBITDA multiples show that investors are willing to pay $13.60 for a single dollar of EBITDA from a large MLP, but only $9.60 for a single dollar of EBITDA from a smaller MLP.

Although the data set above is not robust enough to pass an academic peer review, it does illustrate the market’s perception that bigger is better.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future price ranges or “confidence intervals” for crude oil and natural gas.

The graphic below shows the crude oil price on May 2, 2016 and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the May 2, 2016 prices, the markets indicate that in mid-June, there is about a 68% chance that oil prices will be between $39.00 and $52.50 per barrel. Likewise, there is about a 95% chance that prices will be between $31.50 and $61.50. For a longer-term view, I am also showing the year end ranges, which indicates that by mid-December 2016, the +/- 1σ price range is $35.50 to $64.00 per barrel. This upward skew in the price ranges also drives the expected midpoint of $47.30 per barrel at year end. All in all, it was a great month for oil investors with average futures prices going up around $8.00 per BBL.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at about $2.00 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, in mid-December 2016, the +/- 1σ price range is $1.70 to $3.20 per MMBTU and the 2σ range is $1.25 to $4.05 per MMBTU. The expected midpoint of natural gas prices is $3.10 at year end.

For more information, contact:

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.

To receive updates on our news and blogs.

We will never share your data!

ValueScope’s Oil & Gas Price Outlook: April 4th, 2016

Oil & Gas Price Outlook April 2016

If PUDs are “free,” we may be a buyer at that price!

As E&P companies are releasing their year-end 2015 financials, they all show significant write-offs for the value of their Proved Undeveloped Properties, or “PUDs.” These are driven by their independent engineer’s calculations that many of their PUDs have no value at current prices. As shown below, Chesapeake Energy’s PUDs were written down on average 60% over the 12-months ending December 2015.

Their engineer’s calculations following a standardized discounted cash flow model which, if negative, shows a zero value for the PUD location. The real question is that IF these PUDs are worth zero dollars, then why are so many private equity groups lining up to buy them? The simple answer is called the option value of the PUDs.

Real Options

In general, a financial option gives the holder the right, but not the obligation, to act (or drill in this case). A PUD location can be thought of as a call option, i.e., the holder has the right but not the obligation to drill and produce the hydrocarbons at prevailing commodity prices.

In option terminology, drilling the well is like paying the “strike price” of an option to receive the present value of the future production (analogous to a “stock price”). A simple form of this model is called the Black Scholes model. To make up a simplistic example, let’s say a PUD had an expected value for its production of $3 million and it would cost $4 million to drill, frac and complete. Therefore, the net value of that well is a negative $1 million if drilled at today’s prices.

However, owners have the option to not spend those funds now, and if no volatility in prices were assumed, the option value is zero (versus a negative $1 million). However, considering the volatility of oil and gas prices, the model shows that there is value to this option. In this simplistic example, at an assumed 25% volatility, the PUD would be worth $248,000 and at 50% volatility it would be worth $759,000. So is this a sure thing? Of course not, but optionality has value and PUDs are a classic real option.

Crude Oil Outlook

While futures markets aren’t a crystal ball, their price levels and related options are useful for estimating future price ranges or “confidence intervals” for crude oil and natural gas.

The graphic below shows the crude oil price on April 4, 2016 and predicted crude oil prices based on options on oil futures contracts (ticker /CL). The blue lines are within one standard deviation (σ) of the settlement price (green line) and the red lines are within two standard deviations for each month (for a refresher on standard deviations, see the January 2016 blog).

Based on the April 4, 2016 prices, the markets indicate that in mid-May, there is about a 68% chance that oil prices will be between $33.00 and $39.50 per barrel. Likewise, there is about a 95% chance that prices will be between $28.50 and $43.50. For a longer-term view, I am also showing the year-end ranges, which indicates that by mid-December 2016, the +/- 1σ price range is $30.00 to $58.00 per barrel. This upward skew in the price ranges also drives the expected midpoint of approximately $41.00 per barrel at year end.

Natural Gas Outlook

We can do the same thing for natural gas futures, currently trading at about $2.03 per MMBTU on the Henry Hub (ticker /NG). Although more affected by seasonal factors than crude oil, six months from now in mid-October 2016, the +/- 1σ price range is $1.75 to $3.05 per MMBTU and the 2σ range is $1.25 to $4.25 per MMBTU.

Tags: Oil & Gas Price Outlook April 2016, Oil Price Outlook, Gas Price Outlook, Natural Gas Price Outlook, Crude Oil Price Outlook

Thomas J. McNulty CQF, FRM, MBA

PRINCIPAL AND MANAGING DIRECTOR, HOUSTON

Brad R. Currey, CEIV, CFA

DIRECTOR – ENERGY PRACTICE LEADER

If you liked this blog you may enjoy reading some of our other blogs here.

To receive updates on our news and blogs.

We will never share your data!